The New Age of Hot Briquetted Iron (HBI): How will the Steel Industry Transform?

As the reality of carbon neutrality as a global trend unfolds and pressures of net-zero carbon initiatives increase, it is evident that, despite these developments, the global economy cannot do without the versatile material of steel.

In 2020’s “Iron and Steel Technology Roadmap,” the International Energy Agency (IEA) projected global steel demand to rise by 10 percent by 2050, noting how deeply engrained steel is in our society, from construction to infrastructure and transportation. The report also pointed out that many technologies of a net-zero energy transition rely heavily on steel, such as wind turbines, solar panels, as well as carbon capture and storage technologies.

Given this projected increase in demand, coupled with rising pressure to reduce carbon emissions, the industry is searching for efficient, adaptable, low-carbon solutions on its path to net-zero emissions by 2050. As these projections confront the status quo of the iron and steel industry, several aspects of future-proof strategies emerge:

- decrease in integrated steel production (using the blast furnace and basic oxygen furnace)

- increase in electric steelmaking (using the electric arc furnace)

- increase in scrap usage

- increased use of direct reduction, producing direct reduced iron (DRI), and especially, hot briquetted iron (HBI)

LOW-CARBON INNOVATIONS

As the steel industry moves toward carbon neutrality in response to increasing pressures to decarbonize, the application of DRI and HBI will see immediate benefits for steel producers. HBI is an exceptionally flexible product as well. Taking the place of traditional pig iron for primary steel production, HBI can also supplement lower-grade scrap, enabling higher grade steel products. The supplement of HBI for lower-grade scrap dilutes the metallic impurities often found in scrap-based steelmaking and can even allow, for example, for the production of flat products, which have been an exclusive product offered by the integrated steel production route using virgin materials.

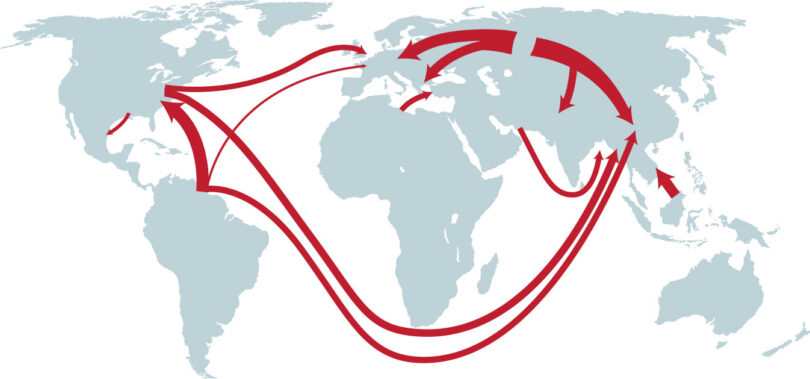

Yet, HBI has also made a name for itself beyond its ability to reduce carbon emissions and its versatile applications, namely in its ability to be shipped far and wide. For HBI, re-oxidation is not an issue. This means that regions rich in raw materials with low energy costs can readily produce HBI and ship this valuable material to steelmaking facilities worldwide (see Figure 1). However, countries have begun establishing barriers to compensate for carbon emissions through carbon prices on selected imports, such as the E.U.’s “Carbon Border Adjustment Mechanism” to tackle climate change. Thankfully, since natural gas-based HBI has a significantly lower carbon footprint than traditional blast furnace-based hot metal, these new trade regulations should not impact HBI as a global commodity. Moreover, carbon pricing schemes coupled with carbon border taxes will only make merchant DRI more competitive worldwide.

FIGURE 1.

DRI/HBI trade map (from Midrex Technologies 2020 World Direct Reduction Statistics)

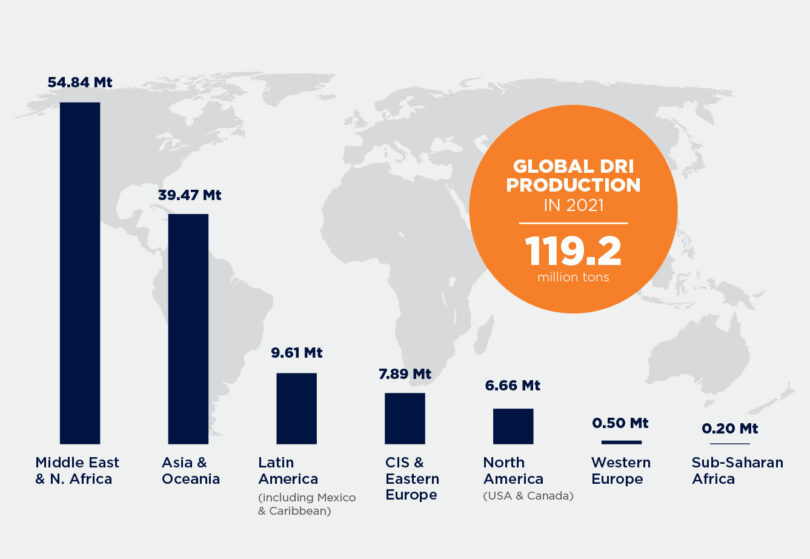

The global growth of annual DRI output already reflects the future competitiveness and impact of these developments. In 2019, DRI production hit a record 108.1 million tons (Mt), which was 7.3% more than the previous year. In 2021, DRI production reached 119.2 Mt, up by 10.2% from 2019 (see Figure 2).

FIGURE 2.

Map showing world DRI production by regions (courtesy of Midrex Technologies’ 2021 “World Direct Reduction Statistics”).

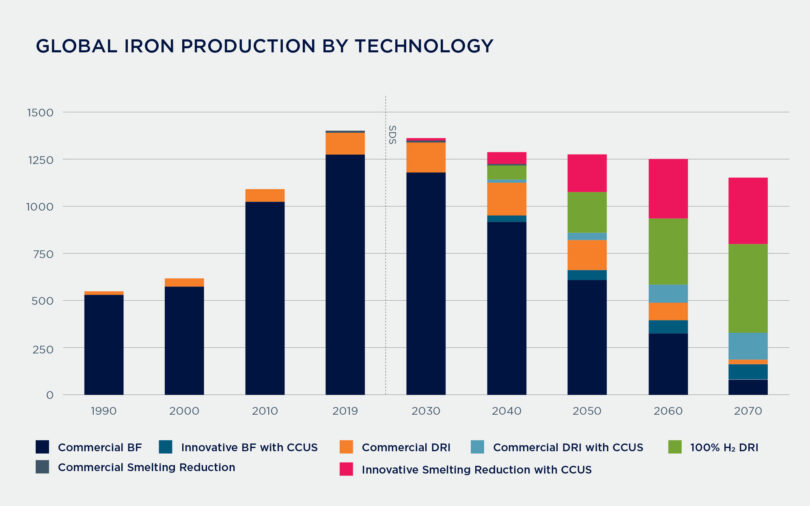

According to estimates in its “sustainable development scenario,” the International Energy Agency (IEA) projects the market for commercial DRI to continue its growth from 115 Mt per year in 2019 to 157.3 Mt by 2030 (see Figure 3). At the same time, the IEA expects that gas-based DRI will account for 8% of steel production by 2030.

FIGURE 3.

Global iron production by technology in the “sustainable-development scenario” (SDS) from 2020 onward, according to the International Energy Agency (BF: blast furnace; CCUS: carbon capture, utilization, and storage; DRI: direct reduced iron)

Access to natural gas and iron ore deposits is vital for developing new direct reduction capacities. But access to energy for clean hydrogen production will become even more relevant in the future.

REGIONS WITH GREAT POTENTIAL

To fully harness the potential of DRI, it will take production increases that only an entire fleet of new HBI plants can handle. New HBI plants should be situated in areas with access to iron ore and natural gas, or hydrogen. Regions such as Canada, Sweden, and Western Australia, with vast ore deposits and a high potential for renewable energy, seem to be exceptionally well-placed in this regard. The regions’ policymakers and industry leaders have also identified this potential and acted accordingly. Primetals Technologies has also recognized this potential and joined the Heavy Industry Low-Carbon Transition Cooperative Research Centre, established by the Australian Government, to explore the tremendous opportunities in this field.

Meanwhile, the U.S.A. and China are two countries that stand out for different reasons in the race toward carbon neutrality and HBI capacities. These countries have significant EAF steelmaking capabilities but little HBI capacity. Although there are now two HBI plants in the U.S.A., China has no HBI plants, despite investing heavily in its EAF capacity over the last few years. Additionally, China has announced a 2060 net-zero target. As the largest steel producer globally, China will not meet its goal by solely relying on scrap, which is already in short supply. Instead, investment and expansion in electric steelmaking require an increase in merchant HBI.

Some steel producers in regions with high energy costs, such as Europe, are increasingly looking for new solutions. For example, in 2016, Austrian steel producer voestalpine began operating an HBI plant near Corpus Christi, Texas (Editor’s note: ArcelorMittal acquired 80% interest in July 2022 and now operates the plant as ArcelorMittal Texas HBI) to import the HBI back to Austria. By signing off-take agreements with HBI producers or even building their own HBI plants in areas with lower energy prices and transporting the HBI for use in their domestic operations, these producers have found solutions to meet current demands.

Despite some promising increases in HBI production in 2021, including Cleveland-Cliffs’ HBI plant in Toledo, Ohio, the demand for HBI will undoubtedly multiply over the coming decades. Thus, current production capacities will struggle to meet the growing demand.

THE HBI PLANT: H2-READY

While global growth in the area of HBI production is undoubtedly on the horizon, producers looking to increase capacity run the risk of increasing their carbon emissions. However, as renewable technologies expand in adoption worldwide and alternative energy sources contribute to a growing hydrogen economy, HBI has one key advantage, namely, the possibility for future hydrogen-based production.

According to the IEA’s projections, fully hydrogen-based DRI will account for 3.9 Mt of global production by 2030. Based on these projections, hydrogen-based DRI and smelter reduction coupled with carbon capture and storage will continue to grow until they dominate ironmaking by the 2070s. The IEA’s projections are not just theoretical dreams but reflect an international trend toward low-CO2 HBI and DRI systems that are hydrogen-ready today.

As carbon pricing and other regulatory measures impact ironmaking, the reality of competitive hydrogen-based production in the global marketplace may be closer than we assume. Still, access to (or at least a long-term perspective for) low-carbon or green hydrogen from renewable energy will be decisive for industry leaders.

While carbon neutrality and hydrogen technologies become more than mere talking points, some analysts now expect the price of hydrogen to drop much sooner than anticipated. Additionally, increased production capacities for green hydrogen from electrolysis—using electricity to obtain hydrogen from water with renewable energy—and turquoise hydrogen from pyrolysis—using natural gas to yield both hydrogen and black carbon and produce fewer carbon emissions—will drive down the cost of hydrogen-based production.

MIDREX HBI PLANT: CORPUS CHRISTI, TEXAS, U.S.A.

Annual capacity: 2 million tons

Input material: 100% DR grade pellets

Furnace type: MIDREX MEGAMOD®

Inner diameter of reduction furnace: 7.15 meters

Number of reformer bays: 20-bay reformer with 600MA-1 reformer tubes (250 mm)

HBI metallization: 93%

Carbon content: 1.5%

Other plant features:

- Environmentally friendly burners for NOx reduction

- Flue-gas hot fan to reduce electric power consumption

- Hot-fines recycling system

- Level 1 & Level 2 automation, including the DRIPAX® DR Optimizer

MIDREX HBI PLANT: CORPUS CHRISTI, TEXAS, U.S.A.

With ironmaking technologies that anticipate carbon neutrality, Midrex Technologies and Primetals Technologies are paving the way for the new age of HBI.

GREEN METALLURGY AND THE FUTURE

With an eye toward the future, Midrex Technologies and Primetals Technologies can produce high-quality HBI with the most environmentally friendly technology for ore-based iron-making. The natural gas-based MIDREX® Direct Reduction Process releases 50% fewer carbon emissions than blast furnace ironmaking. Combine this technology with green hydrogen, and there is potential to decrease carbon emissions even further.

With a proven history in HBI plant construction, Midrex Technologies and Primetals Technologies have successfully implemented plants worldwide to meet the increased demand for merchant HBI. With a reputation for future-oriented innovation, the newest plants can be adapted to use hydrogen as a reducing agent in any range up to 100% once this green energy source becomes economically viable.

DIRECT REDUCTION: TECHNOLOGY THAT EXCITES

What makes direct reduction fascinating?

Unlike other processes, direct reduction is a unique technology thanks to its ability to use natural gas and hydrogen as a reducing agent. By implementing direct reduction, iron and steel producers are able to reduce CO2 emissions significantly.

What makes the global transformation of the iron and steel industry so exciting?

In my view, the current transformation is unparalleled because it represents a global approach and multi-national cooperation of various stakeholders toward the goal of reducing CO2 emissions. As metal producers explore new frontiers by adopting new technologies, the viability and consideration of new regions—including those rich in natural gas or areas primed to produce green hydrogen—will create new opportunities for partnerships and frontrunners in the industry.

What makes H2-ready technologies so essential to the iron and steel industry?

Using hydrogen and green electricity as primary energy sources is the steel industry’s ultimate goal. Natural gas-based direct reduction, which is H2-ready, responds to the challenges steel producers face today. For the future of the metals industry, Primetals Technologies offers and develops technologies that can considerably reduce CO2 emissions throughout the iron and steel production chain.

WOLFGANG STERRER

VP, Direct Reduction Primetals Technologies

(This article is based on an article published in Primetals METALS Magazine and posted online on February 28, 2023)