The Iron Ore Challenge for Direct Reduction On Road to Carbon-Neutral Steelmaking

INTRODUCTION

To quote Clare Broadbent, Head of Sustainability at worldsteel: “Steel is in the spotlight today, as we’re classified as one of the ‘hard-to-abate’ sectors. It’s a really exciting time for the industry. We’ve never had so much attention before, nor as many people wanting to help the industry reach the targets we’re setting for ourselves to become a low-carbon, or carbon neutral industry.”

Various pathways to decarbonisation of the steelmaking process are taking shape across the global industry; the ultimate, long-term goal being a transition from the integrated blast furnace/basic oxygen furnace (BF/BOF) route to electric arc furnace (EAF) steelmaking. Much has been written by many on the numerous factors involved in the choice of strategy, and it is not the intention here to repeat what has already been well documented.

What is significant is that decarbonisation represents an enormous opportunity for the direct reduction sector right across its value chain, be it as EAF feedstock, enabling the steel circular economy through dilution of harmful residual metallic impurities in steel scrap, or as BF burden feedstock, enabling reduced CO2 emissions. However, the opportunity presented by the sheer scale of the transition is not without its challenges, and one of these – the future supply of high-grade iron ore – is the focus of this article.

THE OPPORTUNITY

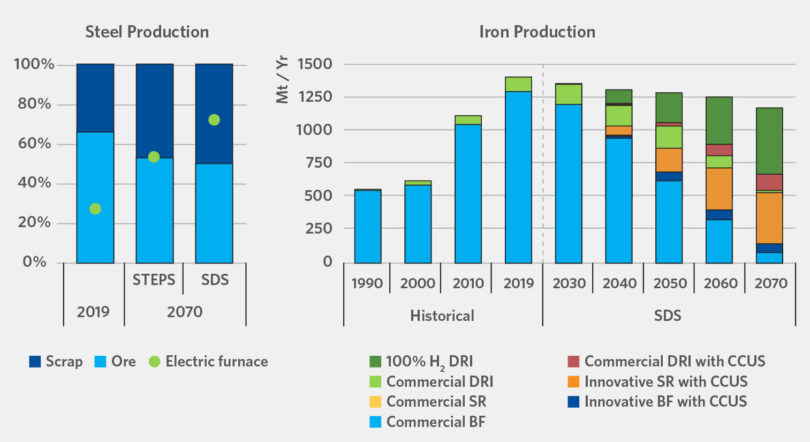

Work by the International Energy Agency (IEA) provides useful context for this article. IEA’s publication, “Energy Technology Perspectives 2020” includes the chart shown as Figure 1 in its chapter on steel.

FIGURE 1.

Global Steel Production by route and iron production by technology in the Sustainable Development Scenario (SDS)

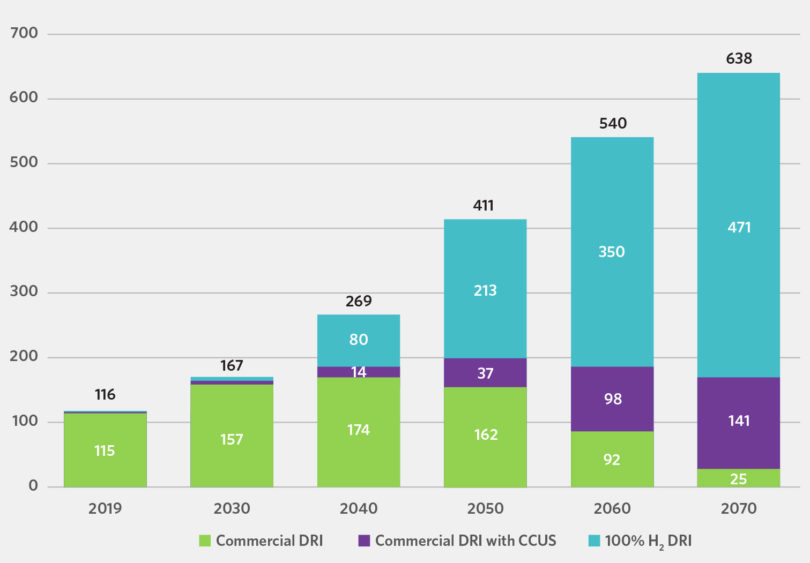

Figure 2 shows the direct reduced iron (DRI) data from Figure 1 per IEA’s Sustainable Development Scenario. Production of commercial or conventional DRI maintains positive growth out to 2040, but then starts to fall away with the growth of hydrogen-based DRI and conventional DRI coupled with Carbon Capture, Utilisation, and Storage (CCUS). The total of 411 million tonnes (mt) predicted for 2050 compares with the 108 mt produced in 2019, an increase of 280%.

A more conservative view was presented in October 2020 by World Steel Dynamics (WSD). Its “Global steel production outlook to 2050” estimated DRI production in 2050 at 272 mt.

FIGURE 2.

DRI Production by technology in the Sustainable Development Scenario (mt)

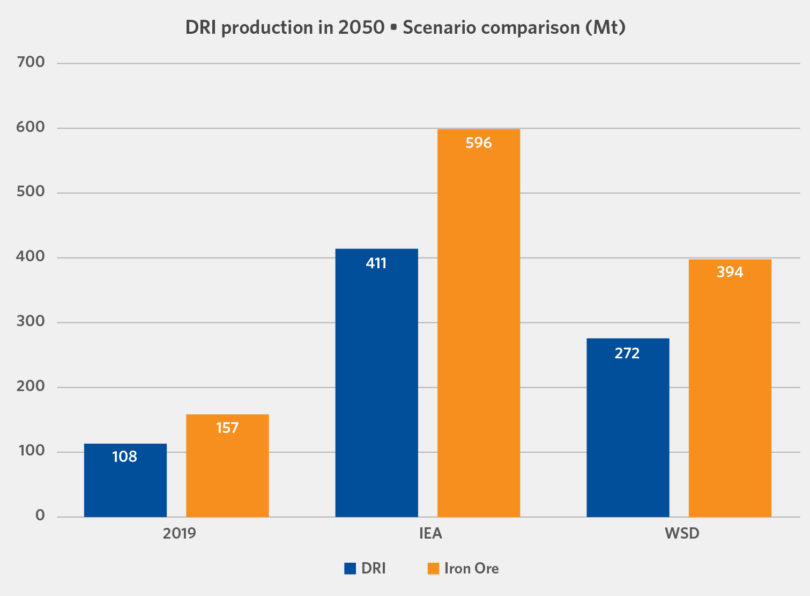

THE IRON ORE CHALLENGE

Figure 3 shows a comparison of the IEA and WSD views and the related iron ore demand of between 400 and 600 mt by 2050, compared to about 160 mt in 2019. From the quantitative perspective, iron ore supply should not be an issue, with BF iron production falling from just under 1.3 billion tonnes in 2019 to 665 mt by 2050 per IEA’s SDS (see Figure 1). This is equivalent to about 2 billion tonnes and 1 billion tonnes iron ore, respectively.

The incremental iron ore demand of about 440 mt from increased DRI production could be met, assuming adequate replacement of depleted reserves. However, from the qualitative perspective, there is a potentially serious problem. This is the iron ore challenge!

FIGURE 3.

DRI production in 2050

IRON ORE QUALITY

The quality requirements of iron ore for direct reduction are well known and will not be detailed here, but are in essence:

The quality requirements of iron ore for direct reduction are well known and will not be detailed here, but are in essence:

- Fe content as high as possible: minimum 66%, ideally > 67%

- acid gangue (SiO2 + Al2 O3) content as low as possible: ≤ 3.5%, ideally, maximum 2%

- Phosphorus (as P2O5) as low as possible: ideally ≤ 0.015% but maximum up to 0.08%, depending on the final steel product

Iron ore quality has deteriorated progressively over the last 20 years or so. Data from Raw Materials & Ironmaking Global Consulting indicate that the average Fe content of a representative group of sinter feed ores fell from 63.9% in 1998 to 61.9% in 2019, while average SiO2 + Al2O3 content increased from 5.11% to 7.08% and phosphorus content increased from 0.048% to 0.067% over the same period.

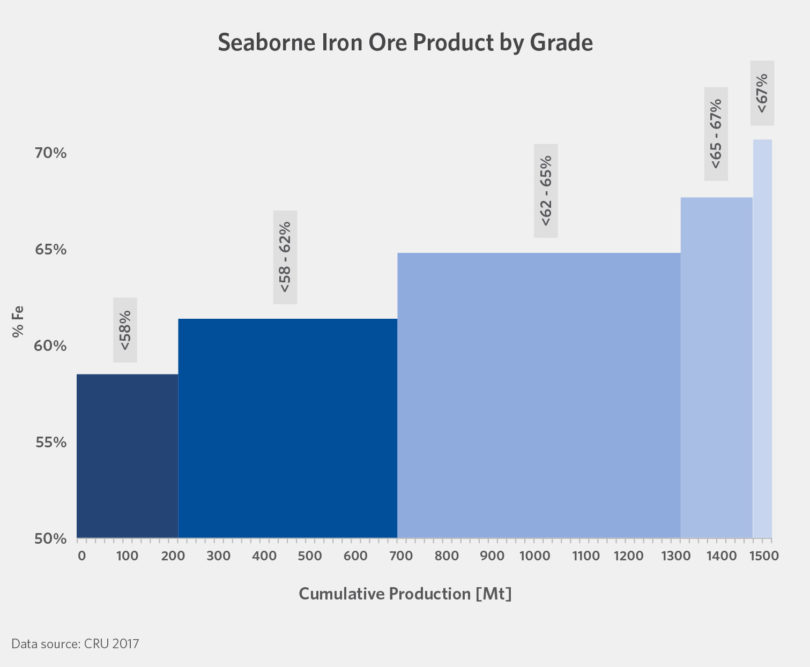

Conversely, the quality of seaborne iron ore pellet feed and concentrates over the same period has remained rather constant, as has the quality of seaborne DR grade pellets, although in some cases this masks the need for additional beneficiation and concentration of the source ore in order to maintain grade. The proportion of high-grade iron ore with > 67% Fe is relatively small, as shown in Figure 4.

FIGURE 4.

Seaborne iron ore product by grade

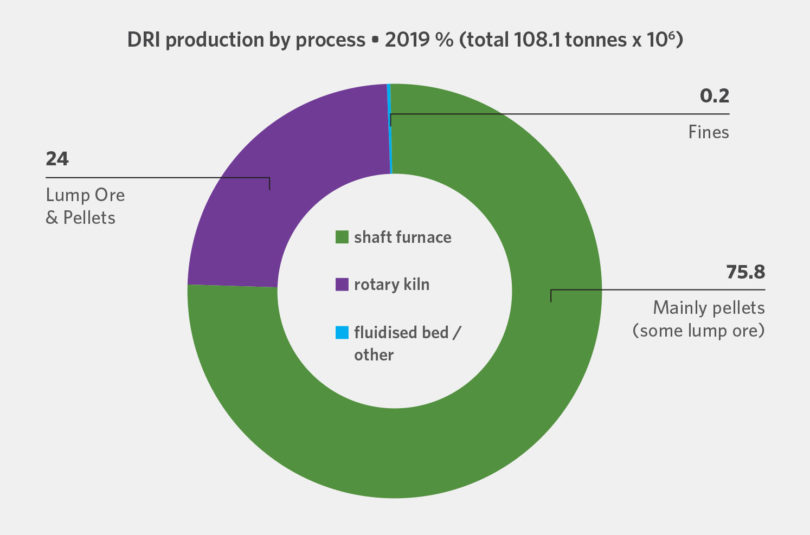

Figure 5 shows the share of DR production by process in 2019 from which it is clear that shaft furnace processes are by far the most significant, the principal feedstock ore being pellets.

FIGURE 5.

Share of DR production processes in 2019

DR GRADE PELLETS – SUPPLY-DEMAND BALANCE

IIMA’s analysis of demand for pellets by DR plants based on purchased ore, both existing plants and selected new projects, indicates that there should be an adequate supply by the middle of the current decade, despite the current tightness of the market. However, complacency should not be an option, as free supply capacity could quickly disappear if more new projects with short lead times are announced. Also remember that pellet producers have the option to supply the BF and sinter feed markets if demand and margins are more attractive. It is also clear that the current situation in Ukraine could lead to a sustained reduction in supply of DR-grade pellets.

The picture changes as we approach the early 2030s, by which time most of the new DR projects so far announced will be in production. IIMA’s analysis suggests a significant shortfall in DR-grade pellet supply, as the capacity of the existing pellet producers: Vale, Samarco, Iron of Company of Canada (IOC), ArcelorMittal Mines Canada, LKAB, and Bahrain Steel becomes fully utilized. IIMA’s view is that by 2030, all Russian and Ukrainian DR grade pellets will be fully utilised in their respective domestic markets.

Looking to the longer term, with global demand for DRI reaching 411 mt by 2050 according to the IEA sustainable development scenario, the challenge is significantly greater, with potential pellet demand exceeding 2019 global pellet production of 463 mt, of which almost 40% was in China and India.

SOLUTIONS TO THE CHALLENGE

It is abundantly clear that the challenge is by now well recognized along the iron ore and steel value chain, with a variety of co-operation agreements in place between the major iron ore producers and their customers to explore solutions to the challenges of decarbonization. The issue of DR-grade iron ore is also on the agenda of the World Steel Association’s Raw Materials Committee. IIMA doesn’t pretend to have all the answers but offers the following thoughts.

SHORT-TO-MEDIUM TERM (OUT TO THE LATE 2020s)

Increased production from existing suppliers such as Samarco will add to the supply. As the available supply becomes committed, the simplest answer is increased use of lower grade pellets as DR feedstock. However, the result is lower grade DRI. Lower grade DRI/ HBI is problematical from the EAF perspective with significant value-in-use demerits, but not so where the more flexible BF is concerned.

Scope for increased use of lump ore is limited by the availability of suitable material, with Kumba’s high grade Sishen lump being the principal internationally traded material. There is the potential for production of a DR-grade lump product by Baffinland Iron Mines in the far north of Canada, but this is dependent on the company obtaining approval for its expansion project.

Introduction of an electric smelting step between the DR plant and the steel shop is a technology already offered by several suppliers and plant builders. For example, thyssenkrupp Steel plans to produce “electric hot metal” by smelting DRI prior to charging it to its BOF converters. Such technology offers a possible longer-term solution for the Pilbara iron ore producers in Western Australia, whose ore is difficult and costly to beneficiate to DR quality.

As the transition from BF/BOF to DR/EAF takes effect, some pellet producers out of necessity shift supply from the BF to the DR sector. Some already have upgraded their beneficiation plants to enable production of DR-grade pellets, notably in the CIS countries. However, given existing and planned DR projects in the CIS, it seems likely that by the late 2020s all or most CIS-produced DR feedstock will be consumed domestically, with the exception of pellets from Ukrainian producer Ferrexpo, which is well-located to supply European DR plants.

Both Canadian pellet producers, IOC and ArcelorMittal Canada, have plans to increase supply to the DR sector. ArcelorMittal recently announced plans to upgrade 100% of its 10 mt pellet capacity at Port Cartier to DR-grade.

Vale’s cold-bonded briquette product offers significant potential, but its suitability as DR feedstock has yet to be demonstrated. Vale has three briquette plants already under construction in Brazil and has the eventual goal of 50 mt briquettes, including a plant in Oman.

LKAB merits mention. It has announced its longer-term strategy of transitioning from a supplier of pellets to a supplier of HBI, with six DR plants planned from the late 2020s to the mid-2040s, three each at Malmberget and Kiruna. This would mean progressive withdrawal of about 7 mt DR-grade pellets from the international market. Part of the HBI would be destined for SSAB’s steel plants in Luleå and Raahe (LKAB is a partner, together with SSAB, in the HYBRIT project, which aims at fossil-free steel production).

LONGER-TERM

More pelletising capacity will be required, both brownfield and greenfield. There are a few failed pellet projects with DR quality capability which could be revived; for example, New Millennium Iron’s LabMag and KeMag projects in eastern Canada, Mesabi Metallics’ project in Nashwauk MN, and various joint venture projects in Mauritania. Other projects doubtlessly will emerge.

The model adopted by Tosyali Algerie of installing a pelletising plant alongside its DR plant is one that should be considered by prospective producers of DRI. SULB/Bahrain Steel is a similar example. Tata Steel’s planned DR plant at IJmuiden in the Netherlands will utilise pellets from the existing on-site pelletising plant. The concept of captive pellet supply can of course manifest itself in other ways, such as joint ventures with iron ore producers, for example the recently announced MoU between Emirates Steel Industries and iron ore producer SNIM in Mauritania.

Investing in a captive pelletising plant shifts the sourcing to pellet feed. Currently, the current commercial availability of DR quality pellet feed is limited to a small number of suppliers, notably Anglo American’s Minas Rio operation in Brazil (under contract with Bahrain Steel), Kaunis Iron in Sweden (producing about 2 mt of high-grade concentrate with plans to expand production), Champion Iron in eastern Canada (with a strategy to increase the share of DR-grade concentrate in its production) and CMP in Chile, which produces several high grade magnetite concentrate products. Tosyali Algerie’s model of addition of a captive ore beneficiation plant will give it considerable flexibility in sourcing pellet feed.

There are various new projects at different stages of development aimed at production of high-grade iron ore concentrate including Black Iron’s Shymanivske project in Ukraine (first phase 4 mt, second phase 8 mt, 68% Fe pellet feed concentrate), several projects in Scandinavia (Nordic Iron Ore and Beowulf Mining in Sweden, Tacora Resources in Norway), and various magnetite projects in Australia (including Grange Resources’ Southdown project, Hawsons Iron, and Magnetite Mines).

Finally, consideration should be given to fines-based DR processes, of which Circored and HYFOR are examples, the former using fines 0.1-2 mm, the latter using concentrates up to 150 µm.