Outlook for DRI Production and Use

INTRODUCTION

Since getting involved in the “alternative iron” space in the late 1980s, I’ve watched the industry grow, face some setbacks, and rebound even stronger. It is hopeful and energizing to see all the recently announced direct reduced iron (DRI) projects materialize along with the increased attention to hydrogen as a key ore reduction gas helping decarbonize the steel sector in its quest to reach net-zero emissions by 2050. Therefore, I see a bright future ahead for DRI and other ore-based metallics (OBMs).

PAST TO PRESENT

From the late ‘80s, a period when companies were constructing electric arc furnace (EAF) mills across the USA to make high quality and specialty steels, concerns for the diminishing quality and quantity of prime grades of scrap began increasing and OBMs; i.e., merchant pig iron, DRI in its various physical forms, and iron carbide started to be viewed as essential supplemental feedstocks in steelmaking. OBMs are needed to enrich furnace scrap charges by diluting copper and other unwanted metallic elements inherent in ferrous scrap. An additional benefit of OBMs is the ability to use higher percentages of lower cost obsolete scrap in the charge and still meet exacting steel quality specifications.

On a straight-line basis, the annual growth for global DRI production since the ‘70s has been about 3 Mt per year. However, there has been accelerated growth in production since 2016 (72.8 Mt) to nearly 8 Mt per year. By product type, the growth rates are decidedly different. In the last 20 years, cold DRI (CDRI) enjoyed a near treble increase in volume, from 39 Mt to 102.1 Mt, with the general growth of widely accepted and proven natural gas-based and coal-based reduction technologies. Hot DRI (HDRI) production has soared nearly eight-fold in the last 20 years, increasing from 1.8 Mt in 2003 to 13.9 million in 2022. The rapid rise in HDRI use in the EAF is from the recognition that it provides the benefits of quicker melting and an energy savings from the retained, latent heat. However, global hot briquetted iron (HBI) production has increased only marginally, from 8.6 Mt in 2003 to 11.4 Mt in 2022, despite being the most desirable DRI form for seaborne trade. The reason largely falls to diminished production in Venezuela, the one-time leader in HBI output, following a second round of nationalizations of the iron & steel industry since the 1970s, most recently starting in 2008 under former President Hugo Chavez.

WILL OBM GROWTH RATES BE SUSTAINED?

I am cautiously optimistic that the answer is “yes,” with the accelerated production and use of all forms of DRI. New iron ore briquetting hubs, such as those announced by Vale, will likely rise to serve multiple off-takers in targeted regions to feed both existing and new DRI plants. DRI-to-EAF steel mill complexes will be constructed where energy and raw materials are either most abundant or served at lowest cost. Owners of DRI-EAF steelmaking plants seeking long-term raw material security will increasingly recognize cost and quality benefits of using OBMs. Given that scenario, captive production and merchant HBI sales may once again rise to the higher growth trajectories of CDRI and HDRI.

Some caution centers on how such global growth might be impacted by unknown and unexpected external “black swan” events that can completely interfere with new project investments and plant output. Several new DRI plants were built in the U.S. during the 1990s (including one dismantled and relocated from Scotland to Mobile, AL), only to face steel downturns and volatile natural gas pricing, leading to their shutdown in the 2000s. Two plants, including the one originally from Scotland, were deconstructed and relocated to places where natural gas was abundant and prices less volatile (specifically Trinidad and Tobago and Saudi Arabia). Examples of “black swan” events include past oil crises, the Global Financial Crisis (mid-2007 to 2009), Covid-19, (2020-2023), the Russia-Ukraine war (on-going since Feb. 2022), and now the Israel-Hamas conflict and associated proxy group attacks launched from Lebanon, Yemen, and Syria. Any additional “black swan” events, such as a broadening Middle East conflict or another global financial or energy crisis could easily stop or delay DRI projects and undercut growth projections. Another concern is the long-term availability of DRI plant feedstocks: DR-grade pellet and lump iron ore (+67% Fe, gangue minerals under 2%), and the extent to which higher gangue BF-grade iron ore (64% Fe, ~5% gangue) converted into DRI will be accepted by EAF steelmakers.

THE NEAR TERM

As DRI demand is fundamentally driven by steel demand, let’s first look at World Steel Association’s (worldsteel) latest Short-Range Outlook, which forecasts demand for finished steel products through 2024. Following a setback in 2022 to 1,782.5 Mt, worldsteel expects 2023 global steel demand will be up 1.8 percent to 1,814.5 Mt, followed by a 1.9 percent increase in 2024 to 1,849.1 Mt (a 34.6 Mt increase led by India and other Asia excluding China. These are rather weak growth rates given what we’ve witnessed in the last several decades with the rise of China to become the world’s largest steelmaker. While the forecast increase in demand is allocated broadly among many countries, the lion’s share of growth is expected in India, which has emerged as the world’s largest producer of DRI (43.6 Mt in 2022). Based on the historical averages, assuming production in- creases in line with demand, 2023 global DRI production should rise to around 130-135 Mt, and 2024 production 133-143 Mt (top-end for both at the 8 Mtpa growth rate since 2016).

MID-TERM OUTLOOK (TO 2030)

Given all the recently announced “green steel” DRI and steel in- dustry decarbonization projects, the accelerated growth rate in DRI production may well continue, such that likely we will be seeing another 60 million tons of incremental DRI output by the end of 2030 to reach an annual level of 185 -190 Mt, rising to 13% of the combined BFI plus DRI ironmaking total.

A 2023 worldsteel presentation by IIMA Chief Advisor Chris Barrington tallied nearly 80 Mt of announced and on- going expansions of DRI capacity, with a significant number of projects scheduled to be in production by 2030. The breakdown by region is roughly as follows: Europe (including Russia) – 34 Mt, MENA – 32 Mt, Asia and Other – 14 mt. According to Mysteel tracking, “In 2022, a total of 20 Mt per year of gas-based DRI production capacity is under construction across the world, which will be gradually put into production in coming years.”

LONGER RANGE OUTLOOK (TO 2050)

Notable forecasts for 2050 DRI production range from 272 Mt (World Steel Dynamics) to 411 Mt (International Energy Agency’s Sustainable Development Scenario), to 549 Mt (Wood Mackenzie’s Accelerated Energy Transition 1.5o C Scenario). When respected agencies’ 2050 forecasts differ by nearly 277 million tons, who do you believe?

I’ve been chastened in my belief that breakthrough smelting reduction technologies would have gained more traction by now as competition to the DRI-EAF steelmaking route. It now seems clear that the “tried and true,” proven DRI technologies will be the ones to proliferate over the next several decades. Meanwhile, advancements in direct smelting technologies could slowly de- velop and ultimately impact DRI plant capacity growth rates. But so far, key to successful DRI technology acceptance has been the ability to provide flexible scale-up and capacity-matching to EAFs from small modules below 0.5 Mtpa to mega-modules over 1.0 Mtpa, reaching levels competitive with BF iron plants (having attained 2.5 Mtpy by a single shaft module). It likely will be a long time before breakthrough direct smelting technologies attain those capabilities and gain broader commercial acceptance.

HYDROGEN-BASED DRI-EAF STEELMAKING

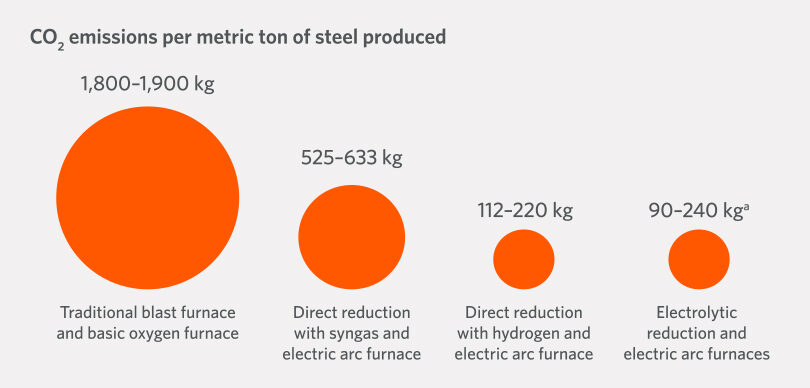

Straight melting of scrap in an EAF combined with “green” power sources such as hydrogen results in much lower emissions and carbon footprint compared to traditional steelmaking. Melting scrap and DRI in an EAF is the next best alternative, as shown in the accompanying graphic9.

On the path to decarbonizing the steel industry, there has been a strong interest in using hydrogen to a greater extent in both iron & steelmaking furnaces along with providing fossil- free electric power from renewable energy sources. Innovative “green steel” technologies in Sweden are employing the two most recognized and proven shaft furnace DRI technologies: H2 Green Steel, using the MIDREX® Process, and the HYBRIT consortium (LKAB, Vattenfall, and SSAB) using Tenova’s EnergIron® DRI technology.

H2 Green Steel (Boden, Sweden)

“Green hydrogen is produced by decomposing water into hydrogen and oxygen in a process known as electrolysis. H2 Green Steel will build a giga-scale electrolysis, powered by fossil-free electricity, as an integrated part of our production site, producing the green hydrogen needed to bring 5 million tonnes of high-quality steel to the market by 2030, with a gradual ramp up starting in 2025. The main area of use for our green hydro- gen will be to reduce iron ore to direct-reduced-iron, DRI (also referred to as iron sponge, more commonly called “sponge iron”). By using green hydrogen instead of coal, we can reduce CO2 emissions from the reduction process with around 95 percent.”

HYBRIT (Vitåfors, Sweden)

“HYBRIT is already planning a larger demonstration plant in Vitåfors, Sweden, which would reach commercial-scale continuous production of 200 t of DRI per hour. (Martin) Pei (CTO of SSAB) says that this plant should help deliver fossil-free steel—which should have a carbon footprint less than 5% of that of conventional steel—to the market in 2026. SSAB plans to replace all its blast furnaces in Sweden and Finland so that it is entirely fossil-free by 2045.”

GLOBAL TRADE IN DRI

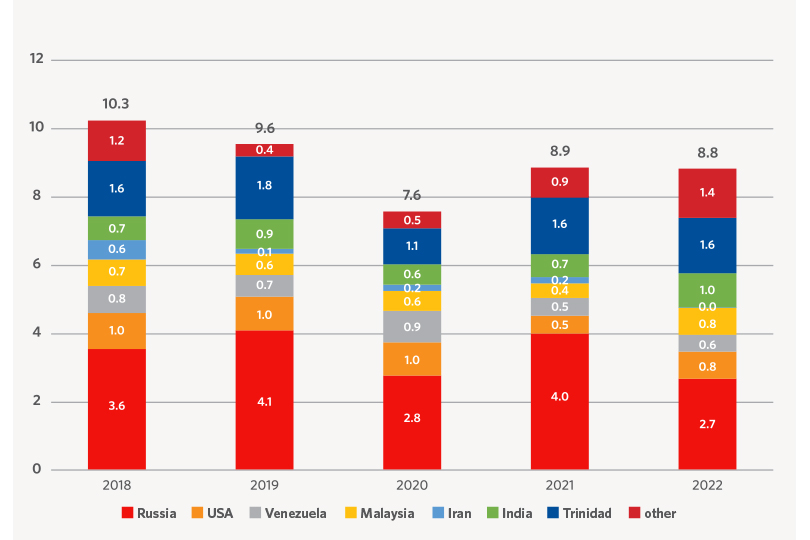

Whether hot or cold in product form, most DRI is used in EAF steel plants adjacent to the DRI plants. Internationally traded DRI is relatively smaller in volume (8.8 Mt exported in 2022), representing only 7% of global DRI produced and 0.6% of global iron production. Exports for 2023 are likely to suffer a setback based on annualized ISSB data. DRI/HBI trade in 2024 may remain subdued given weak consumption growth for finished steel, trade sanctions on Russia impacting HBI trade flows in Europe, and rising Houthi attacks on seafarers (and associated military responses) in the Persian Gulf region. Figure 1 depicts the most recent annual export volumes of DRI.

FIGURE 1.

Global Exports of DRI/HBI, 2018 - 2022

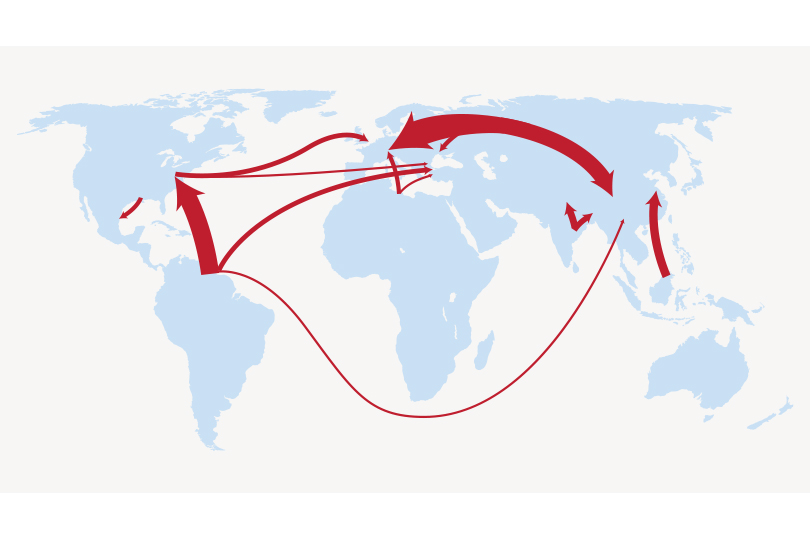

Merchant CDRI is shipped to end users within the same country either by land (rail, truck) or by water (barge on inland waterways). Some is shipped overseas by ocean-going vessel and put to ground storage or transferred to barges. But the bulk of seaborne trade is as HBI, the denser, compacted form recognized to be the best DRI product form for long distance safe handling, transportation and storage. Major trade routes for DRI, as depicted in Figure 2 include Trinidad and Tobago to the USA (CDRI), Russia to China, Turkey and Europe (HBI), USA to Mexico and Austria (HBI), and lower volume and intermit- tent exports (at or under 1 Mt/year) from Iran, India, Malaysia, Libya, Algeria, Venezuela, and other Persian Gulf countries (CDRI, HBI, and/or DRI chips, fines or off-grade products).

An essential part of defining the picture for total demand for DRI/HBI is understand- ing Customs trade data. IIMA, as a subscriber to International Steel Statistics Bureau (ISSB) data services, provides for its members access to global trade statistics for DRI/HBI, mer- chant pig iron, iron ore, and ferrous scrap and generates quarterly reports summarizing trade statistics for the first three products. ISSB up- loads the Customs trade data via IIMA-designed Excel workbooks that facilitate sorting, filter- ing, and delving deeper into the trade patterns. Trade data IIMA receives often contains misclassifications of DRI products, missing information, and occasionally misplaced decimal points in recorded trade volumes. Consequently, IIMA’s Trade Statistics Workforce endeavors to identify and address these problem areas with adjustments and/or estimates to provide proper representation of the trade data.

Midrex, likewise uses and analyzes ISSB data to determine what is and is not DRI/HBI trade. It also collects data from specific plants related to shipping to fill in some blanks in the ISSB data. Midrex records DRI/HBI shipments to third parties by land and water and reports the aggregate numbers in its annual DRI statistics report. Their reporting method results in much larger annual volumes of DRI trade than the purely cross-border trade reported by IIMA. According to Midrex, “shipments of DRI increased to a record of 25.7 Mt in 2022, a 13% increase from the previous record of 22.8 Mt in 2021. Land shipments made up the majority of the total in 2022, amounting to 15.7 Mt. However, water shipments showed a 25% increase compared to 2021.” Land shipments were primarily in India and from India to neighboring regions. Shipments for 2023 and 2024 will likely increase modestly, with land-based plus inland river-based activity offsetting contraction of ocean-going trade activity.

FIGURE 2.

Major Trade Routes for International Trade of DRI

GROWTH IN DRI/HBI USE

Once considered a detriment in steelmaking because of extra gangue materials that increased power consumption and slag rates, the growth in production of DRI/HBI and in- creasing number of steel plants using DRI/HBI implies a growing product acceptance. Being made from virgin iron ore with only trace levels of tramp elements deleterious to steelmaking, a.k.a. “residuals,” (oxides of Cu, Cr, Ni, Mo, Sn, Pb), DRI/HBI use allows for dilution of these unwanted elements found in ferrous scrap. Other recognized applications gaining acceptance include HBI use in blast furnaces for productivity enhancement and in basic oxygen furnaces as trim coolant. For some emerging and developing countries short on scrap, DRI/HBI use has been or is becoming a necessity, particularly where the local scrap reservoir is mostly obsolete ferrous scrap high in residuals.

CONCLUSION

At the outset of this article, I noted both the surge in DRI production and newly announced DRI plants; many of the latter attributed to efforts tied to decarbonization of the steel industry. Based on the growth trajectory, particularly since 2016, the use of DRI/HBI in steelmaking is likewise gaining broad acceptance globally. Hydrogen-enriched gas-based reduction of iron ore in DRI plants, plus arc furnace melting of DRI and scrap, currently offers the primary pathway for lowest carbon emission steelmaking. Other decarbonizing processes and break- through technologies over the longer range will no doubt be applied where practical and economical. But DRI will continue its strong growth as necessary supplements in making high quality steels and in helping to decarbonize the iron & steel industry.

References:

1 For a list of DRI projects announced or under consideration, see IIMA website (metallics.org), Presentations, Whitepaper 3 Appendix 1 (May 2023)

2 Iron carbide technology faced setbacks in the early ‘90s resulting in two commercial plant closures and technology abandonment

3 BF Iron tonnages mostly represent “hot metal” transported as a high temperature liquid to steel furnaces, as distinguished from much lower global volumes hot metal poured and cast in molds (pig iron), and/or granulated and cooled for later use or shipment. World Steel Association BFI annual statistics; 2022 World Direct Reduction Statistics, Midrex, October 2023

4 World Steel Association SRO, October 17, 2023

5 Assuming BF iron production remains at constant 2022 levels

6 “DRI and the Pathway to Carbon-Neutral Steelmaking: Iron Ore Challenges,” Chris Barrington, Chief Advisor, IIMA, 58th meeting of the Raw Materials Committee of the World Steel Association, May 2023

7 SteelMint, “Chinese Mills Eye DRI Usage in Steelmaking to Lower Carbon Emissions,” Oct. 28, 2023

8 Ibid, footnote 4

9 See H2 Green Steel website; italicized entries by this author for clarification

10 IEEFA.org, Solving Iron Ore Quality issues for Low-Carbon Steel, August 2022

11 IIMA 2023 internal whitepaper on OBMs (Customs data from ISSB with interpretive adjustments by IIMA). ISSB data lags of 5-6 months prevent meaningful depiction of 2023 exports

12 2022 World Direct Reduction Statistics, Midrex Technologies, Inc., Sep. 12, 2023, p. 9

13 Pers. Communication with Midrex personnel

14 Ibid (footnote 12), p. 10