North Africa: Focus on Direct Reduction Ironmaking

Introduction

Direct reduction of iron – extracting metallic iron from iron ores without melting the material – is one of the first industrial processes developed by humans. Early ironmakers were unable to achieve the high temperatures required to melt iron ores, so they heated them together with charcoal to produce a pasty, metallic substance which they could hammer into tools and other implements. Today, direct reduction is the fastest growing, most innovative and environmentally clean method to produce high quality metallic iron for steel production.

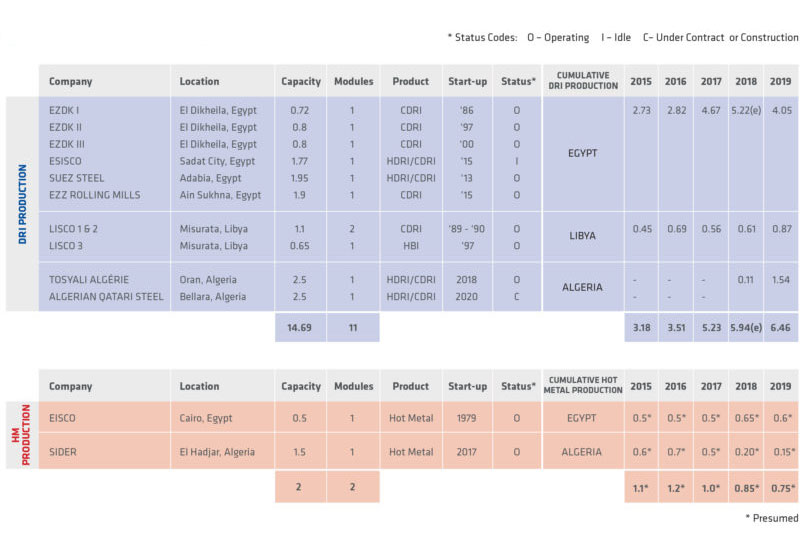

North Africa is in the forefront of the modern age of ironmaking. Eleven direct reduction modules, with a total rated capacity of almost 14.7 million tons, are either installed or under construction in Algeria, Egypt, and Libya. By comparison, there are only two blast furnaces (one each in Algeria and Egypt), with a total installed capacity of 2.0 million tons (TABLE I). DRI production in 2019 was 6.46 million tons compared with approximately 0.75 million tons of hot metal.

TABLE I.

North African Iron Production (DRI vs. HM)

NORTH AFRICAN STEEL INDUSTRY SINCE WW2

Since the end of World War II, Egypt and Algeria have been the leading steel-producing countries in North Africa. The Egyptian Iron and Steel Company, founded in 1954, established the region’s first classically integrated steel mill based on the blast furnace/basic oxygen furnace (BF/BOF). The philosophy at the time was state involvement for generating profitability in the social sense, while economic profitability was secondary. Since the 1990s, as the private sector was granted more access to the steel industry, there have been huge investments in new technologies with the aim of enhancing economic profitability. As a result, direct reduced iron (DRI) production has taken over as the dominant ironmaking method and the electric arc furnace (EAF) in combination with a DRI plant has become the preferred steelmaking route. Beginning with start-up of the first MIDREX® Module in El Dikheila, Egypt, by Alexandria National Steel Company (ANSDK) in 1986, the ability to match steel production to market requirements with the EAF and the opportunity to derive added value from natural gas resources with DRI plants has stimulated growth and self-reliance in the North African steel industry. ANSDK went on to add two more MIDREX Modules in 1997 and 2000, which along with the associated steel mill are now owned and operated by Ezz Steel. The company also operates DRI/EAF facilities in Adabia and Ain Sokhna, Egypt, which include HYL/Energiron Plants, bringing the total installed DRI capacity of Ezz Steel to 5.1 million tons.

Libyan Iron & Steel Company (LISCO) began operating two MIDREX Modules in 1989-90 to feed DRI to its new EAF melt shop in Misurata, Libya, and added a MIDREX HBI Plant in 1997, to take advantage of the growing merchant metallics market. Although the DRI/EAF complex has been disrupted by restricted natural gas supply and civil war in recent years, LISCO increased DRI production in 2019 by more than 55% over 2017.

Algeria is the newcomer to DRI/EAF steelmaking in North Africa. Tosyali Algérie, which has been producing steel rebars in Bethioua (Oran), Algeria, since 2013, began commissioning the world’s largest simultaneous discharge (hot and cold product) DRI plant in July 2018, and commenced cold DRI (CDRI) operation in November 2018. The first hot DRI (HDRI) was transferred to the nearby melt shop in February 2019, and the 2.5 million tons per year MIDREX Plant set the world record for daily DRI production in July 2019 – one year after start-up. A second 2.5 million t/y simultaneous discharge MIDREX Plant is nearing completion in Bellara, Algeria, for Algerian Qatari Steel (AQS), and is expected to start operation in the near future. Additional details of the two plants are included later in this article.

DRI/EAF STEELMAKING IN NORTH AFRICA

There is no doubt that the technology of the blast furnace/basic oxygen (BF/BOF) route has improved steelmaking efficiency, productivity, and product quality compared to the open-hearth furnace. However, the direct reduced iron/electric arc furnace (DRI/EAF) route is a better option for North Africa and the Middle East-North Africa (MENA) region. What makes the DRI/EAF combination attractive when compared to traditional BF/BOF steel production?

- Value-added use of associated natural gas

- Capacity sized to market needs

- More flexibility to deal with market conditions

- Lower capital cost

- Fewer emissions, less solid byproducts

- Less water required

- Capable of meeting the most stringent steel specifications

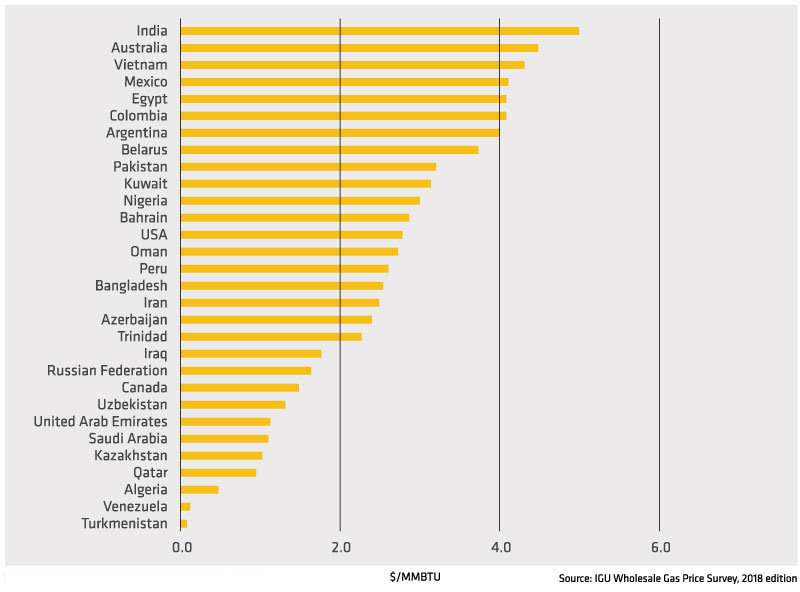

The abundance of natural gas and the low cost of electricity for industrial use are two of the main reasons for the dominance of DRI/EAF steel production in the MENA region. Algeria had the world’s third lowest natural gas price in 2018, as shown in Figure 1, and Qatar, Saudi Arabia, and the United Arab Emirates are among the 10 lowest. Egypt had the 26th lowest natural gas price in 2018.

FIGURE 1.

30 Lowest World Natural Gas Prices

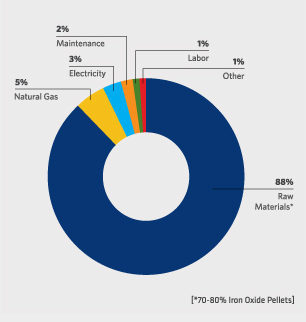

The price of electricity for business in Algeria is $0.036/kWh and $0.073/kWh in Egypt (www.globalpetrolprices.com). However, the reliance on imported iron oxide pellets is a source of concern for the region’s steel producers (iron oxide pellets typically make up 70-80% of DRI OPEX). The development of a regional source, such as in Morocco and in Algeria (Gara Djebilet site), is under consideration.

ALGERIA - THE RISING STAR IN DRI PRODUCTION

FIGURE 2. Estimated DRI OPEX in Algeria

Reasons Algeria is in ascendency:

- Political stability to boost confidence of foreign investors

- Availability of natural gas resources – weight of NG cost in a traditional DRI OPEX (Figure 2)

- Algeria has world’s third-lowest wholesale NG price (only Venezuela & Turkmenistan are lower)

- Strong governmental policies favoring the industrial sector

- Competition with exporting natural gas at higher prices (revenues for the state) vs. using it for national industry development

- Long-term pricing policies for electrical energy for the industrial sector

TOSYALI ALGÉRIE

Tosyali Algérie

Main Features:

- World’s largest combination HDRI/CDRI plant

- 7.65 meters diameter MIDREX MEGAMOD® furnace

- 8 rows x 18 bays MIDREX Reformer

Tosyali Algérie, a subsidiary of Turkey’s Tosyali Holding, started production of steel rebar in Bethioua, near Oran, Algeria, in 2013, using scrap as feedstock. It subsequently added 500,000 t/y of wire rod production capacity, which was started up in 2015. The decision was made to add a direct reduction plant, which was commissioned in 2018 and began production in 2019. It is the world’s largest single module MIDREX Plant (2.5 million tons/year) in operation.

A 4 million tons/year pellet plant was constructed to produce iron oxide pellets for use in the DRI plant and went into effect at the end of 2018. The pelletizing and DRI facilities will significantly contribute to the economy of Algeria by efficiently using the country’s subterranean mineral resources.

ALGERIAN QATARI STEEL (AQS)

Main Features:

- World’s largest combination HDRI/CDRI plant

- 7.65 meters diameter MIDREX MEGAMOD® furnace

- 8 rows x 18 bays MIDREX Reformer

AQS, a joint venture between Qatar Steel International; SIDER, an Algerian investment group; and the National Investment Fund of Algeria, contracted with Midrex and Paul Wurth to supply a 2.5 million tons/year direct reduction plant capable of producing cold DRI (CDRI) and hot DRI (HDRI). The MIDREX Plant is part of an integrated EAF-based steel mill in Bellara, Algeria, 375 kilometers east of Algiers. Construction of the DRI plant was affected by the COVID-19 pandemic in spring 2020, and is expected to begin production in the near future.

ALGERIAN QATARI STEEL (AQS)

WHAT’S NEXT FOR DRI IN NORTH AFRICA

Algeria

If the Algerian Government keeps supporting local industry by selling natural gas at low prices, there is the real possibility to have new plants in Algeria for DRI/HBI production in the mid-term. The possibility of exploiting local iron ore deposits, such as Gara Djebilet in Tindouf Province would further reduce the OPEX for DRI production.

Egypt

The strongest, fastest growing economy in North Africa already has about 8 million t/y of DRI capacity and many years of operating experience, both producing and using DRI. In recent years, production was increased from 30% to almost 60% of rated capacity. However, the issue of natural gas shortages will need to be solved for full utilization of the existing DR plants and the possibility of new construction.

FIGURE 3. Natural gas resources in Morocco Source: World Energy News, 2015

Libya

With an abundance of natural resources, its economic future depends on stabilizing the political and social structure in the next years.

Morocco

As one of the highest rated countries for political stability in the region, it could have a future as a DRI producer thanks to new gas resources found in the southeast (Tendrara, with near-term potential up to 3-4 trillion cubic feet of gas (Figure 3).

Opportunities:

- Abundant natural gas resources

- Close to Mauritanian iron ore mines

- Development of automotive industry (PSA, Renault, Fiat)

Challenges:

- Availability of natural gas for iron & steel industry

- Economics of exporting natural gas to Europe vs. internal use (pipelines in place)

OPPORTUNITY ARISING FROM EU CO2 REDUCTION GUIDELINES

A major challenge for all industries worldwide is how to comply with more stringent environmental emissions standards. The Paris Agreement, which entered into force on 4 November 2016, has a goal to increase the global response to the “threat of climate change by keeping a global temperature rise this century well below 2 degrees Celsius above pre-industrial levels” [1]. Reduction of carbon dioxide (CO2) emissions by the industrial sector is widely recognized as a key to achieving these targets, especially in the iron and steel industry, which is among the largest contributor of greenhouse gas emissions. Iron and steelmaking accounts for almost 7% of mankind’s entire carbon footprint [2]. Ironmaking alone constitutes 80-85% of iron and steel’s total CO2 output. Integrated mills are the largest producers of CO2 by both volume and percentage.

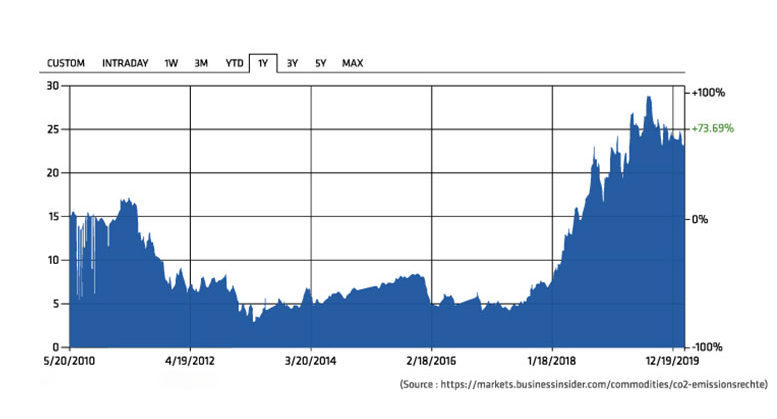

Mitigating CO2 emissions is becoming critical, especially in Western Europe, as the cost of CO2 emissions continues to increase. For example, emission allowance prices quadrupled in 2018 (see Figure 4). The general consensus is that emissions restrictions will get tighter globally and this will severely affect the sustainability of many industries, particularly traditional integrated steelmakers because of their reliance on refined coal (coke) as both an energy source and a reductant to produce high carbon (~4.5%) metallic iron from iron ore.

European ironmaking is largely based on the traditional integrated route (BF/BOF). Based on the world steel industry’s coal consumption, it is estimated that BF ironmaking (including the processing step to make the coke from metallurgical coal) generates approximately 1.8 tons of CO2 for every ton of iron produced. As no proven carbon capture system exists for blast furnaces, the best way for integrated steelmakers to reduce CO2 emissions is simply by not creating the emissions in the first place.

FIGURE 4.

European CO2 Emissions Allowances Prices

Shuttering a certain percentage of BF capacity will no doubt be necessary in the next few decades, but economics will prevent simply replacing BF/BOF works with DRI/EAF mills. A practical way to keep efficient BFs operating is needed. The solution would still involve the benefits of DRI but from an operational standpoint rather than as an outright replacement of BF capacity.

European Union (EU) steelmakers have started to make plans for a gradual shift over the next 20 years to EAFs but there is serious concern about scrap availability. Steel produced with end-of-life (obsolete) scrap in an EAF has the lowest CO2 emissions; however, a plateauing of steel stocks in mature economies coupled with a strong demand growth for steel in developing economies means that scrap supplies are sufficient for only approximately a 22% share of metallic input for global steel production. Scrap supplies are forecasted to grow but the availability of obsolete scrap lags steel demand by 10-50 years following production, depending on the application [3]

A long-term solution is to produce DRI with hydrogen to supplement scrap supplies. However, a near-to-mid-term solution is available now – merchant HBI produced in North Africa for use in the BFs and EAFs of the EU (Figure 5).

FIGURE 5.

HBI Trade Routes From North Africa to the EU

PAUL WURTH AND MIDREX -A POWERFUL RELATIONSHIP

Midrex has a long and successful history of partnering with leading international companies to develop, finance, and construct DRI plants based on the MIDREX Process. These companies are acknowledged leaders in their fields – from design and engineering of iron and steelmaking equipment to development and management of full turnkey iron and steel plant projects. Midrex partners are highly regarded for their technical expertise, adherence to project schedules, and exceptional performance.

Tosyali Algérie and Algerian Qatari Steel, the two largest and most recent MIDREX Plants were supplied by the consortium of Paul Wurth and Midrex. Paul Wurth, headquartered in Luxembourg since its creation in 1870, has developed over the course of its history into an international engineering company. Its considerable know-how and effective policy of innovation has made the Paul Wurth Group one of the world leaders in the design and supply of the full-range of technological solutions for the primary stage of integrated steelmaking (Figure 6). Paul Wurth has been a member of the SMS group since December 2012 and a Midrex Construction Licensee since 2014.

The Paul Wurth scope of supply for the two Algerian projects included engineering (basic for civil and buildings; detail for piping, structural steel, and electrical), equipment and materials supply, and local services.

SUMMARY

North Africa is emerging as a focal point of direct reduction-based ironmaking. Algeria and Egypt are transitioning from the blast furnace/basic oxygen furnace (BF/BOF) steel production route to take advantage of the economy of scale of EAF-based steelmaking and the operating cost advantages of producing and using DRI. Algeria is a rising star in the world of DRI production, with the two largest MIDREX Plants in the world located in the steelworks of Tosyali Algérie and Algerian Qatari Steel (AQS) in Bethioua (Oran) and Bellara, respectively. The potential exists for Morocco to emerge as a significant player due to its natural gas resources, proximity to iron ore mines in Mauritania, and political stability. The guidelines for CO2 reduction in the European Union (EU) could have a positive effect on North African DRI production, as the use of HBI in the blast furnace presents an immediate-to-medium term solution for EU steelmakers. Libya already exports HBI to Europe, and producers in Algeria and Egypt could follow suit. The partnership of Paul Wurth and Midrex has the local experience and proven track record to continue assisting North Africa in its emergence as a direct reduction ironmaking region.

References:

- United Nations Climate Change website (https://unfccc.int/)

- ArcelorMittal Climate Action Report 1 2018, page 10.

- Robert L. Hunter, “Massive Savings in CO2 Generation By Use of HBI,” Direct From Midrex, Midrex Technologies, Inc., Charlotte, NC, 3-4Q 2009, pp 9-11.