MIDREX® Direct Reduction Plants – 2020 Operations Summary

Despite the COVID-19 pandemic that was declared towards the beginning of 2020, MIDREX® Plants produced 65.7 million tons in 2020, 3.0% less than the 67.7 million tons produced in 2019. The production for 2020 was calculated from the 35.5 million tons confirmed by MIDREX Plants located outside of Iran and the 30.2 million tons for Iran reported by the World Steel Association (WSA). Approximately 8.1 million tons of hot DRI (HDRI) were produced by MIDREX Plants, which were consumed in nearby steel shops and assisted them in reducing their energy consumption per ton of steel produced and increasing their productivity.

MIDREX Plants have produced a cumulative total of more than 1,178 million tons of all forms of DRI (CDRI, HDRI, and HBI) through the end of 2020.

MIDREX Technology continued to account for ~80% of worldwide production of DRI by shaft furnaces. At least three MIDREX Modules* established new annual production records and at least nine established new monthly production records (no detailed production information has been received from Iran). Ten additional modules came within 10% of their record annual production and eight operated in excess of 8,000 hours.

Two new modules completed construction in 2020 and were ready to start operations: a 2.5 million t/y module designed to produce CDRI and HDRI, owned by Algerian Qatari Steel (AQS) in Bellara, Algeria, and a 1.6 million t/y HBI module belonging to Cleveland-Cliffs in Toledo, Ohio, USA that started operations at the end of the 4Q of 2020.

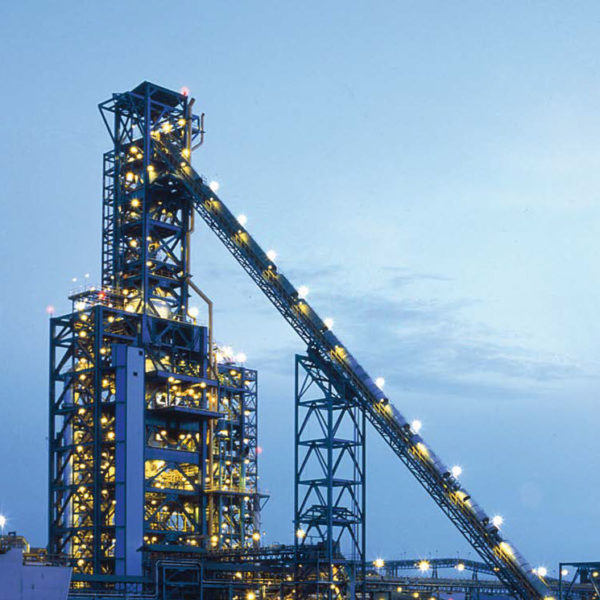

Antara Steel Mills

2020 Plant Highlights

ACINDAR

In its 42nd year of operation, ACINDAR’s module operated at reduced capacity due to challenging local market conditions and was shut down for almost four months at the beginning of the COVID-19 pandemic. With over 32 million tons produced, ACINDAR has achieved the most production from a 5.5-meter MIDREX Shaft Furnace to date.

ANTARA STEEL MILLS

The first MIDREX HBI Module operated over its annual rated capacity and within 6% of its record annual production. Total iron of its HBI product was the highest of all MIDREX Plants, averaging 93.04% for the year. All production was shipped by water to third parties.

ARCELORMITTAL CANADA

After a record production year in 2019, Module 1 operation was impacted by reduced market demand due to COVID, causing a 5-month shutdown of this production module. Module 2 operated above rated annual capacity, despite being down the whole month of May and restarting operations in mid-June.

ARCELORMITTAL HAMBURG

In its 49th full year of operation, the oldest MIDREX Module in operation handily exceeded its annual rated capacity. Even though the plant did not operate at full capacity, its average annual electric energy consumption was the lowest of all MIDREX Plants at 84 kWh per ton.

ARCELORMITTAL LÁZARO CARDENAS

AMLC produced 19% over its annual rated capacity of 1.2 million tons in its 23rd year of operation. Its 6.5-meter reduction furnace has produced a total of 34.6 million tons of DRI, the most by a single module to date.

ARCELORMITTAL POINT LISAS

Forty years after the start-up of Module 1, all three MIDREX Modules in Trinidad and Tobago remained shut down throughout the year.

ArcelorMittal Hamburg

ArcelorMittal South Africa

ArcelorMittal Lazaro Cardenas

ARCELORMITTAL SOUTH AFRICA (SALDANHA WORKS)

After approximately 20.5 years of operation and 10 million tons of DRI production, the COREX® export gas-based MxCol® Plant was idled in January 2020 and remained shut down the rest of the year.

ARCELORMITTAL / NIPPON STEEL INDIA

Early in its 10th anniversary year since its start-up, Module 6 exceeded the 10-million ton mark producing CDRI. With exception of Module 1 (recently converted to produce CDRI only in its 30th anniversary year, together with Module 2), AM/NS’s other five modules operated at less than maximum capacity. Despite a marked reduction in production during the months of April and May due to COVID, the total production of the six modules was 4.54 million tons, which is within 7% of their DRI production record of 4.86 million tons set in 2018. Modules 2, 3, 4, and 5 produced 2.48 million tons of HDRI (over 93% of their production, with the balance being HBI). This increase in HDRI pro-duction and decrease in HBI production reduced their electric energy consumption in the DR plants and increased the benefit of using HDRI in the steel shop. Modules 5 and 6 operated using off-gas from AM/NS India’s COREX Plant for ~18% of their energy input.

COMSIGUA

COMSIGUA’s production of HBI decreased in 2020, restricted by the limited supply of locally produced pellets in Venezuela.

DELTA STEEL

The two modules in Nigeria did not operate in 2020.

DRIC

Both of DRIC’s modules in Dammam, Saudi Arabia, operated above rated capacity and were within 5% of the annual production record of 1.09 million tons DRI set in 2019. Module 1 set a new monthly production record in October 2020. Both of these modules also broke annual average hourly productivity records, and between them exceeded the 10-million ton mark since initial start-up in 2007.

Comsigua

Essar Steel (formerly Essar Steel)

EZDK

ESISCO

After being shut down since January 2016 due to high natural gas prices in Egypt, as well as competition of foreign steel products, Beshay Steel restarted their MIDREX Plant in December 2019 and shut it down again in early March for the remainder of 2020.

EZDK

All three modules operated above rated capacity in 2020. In its 20th anniversary year of operation, EZDK’s Module 3 operated within 10% of its production record with 8,169 hours of operation. Module 2 operated 8,350 hours and surpassed the 20-million ton mark of DRI produced towards the end of 2020. EZDK continued to use lump ore in their oxide feed mix throughout the year.

FERROMINERA ORINOCO

Thirty years after its restart as a MIDREX Plant, Ferrominera Orinoco’s HBI module in Puerto Ordaz, Venezuela, did not operate in 2020 due to limited availability of locally produced oxide pellets.

HADEED

Hadeed exceeded rated capacity for the 36th consecutive year in Modules A and B and for the 28th consecutive year in Module C. With over 22 million tons produced since start-up in July 2007, Module E has achieved the most production from a 7.0-meter MIDREX Shaft Furnace. Hadeed’s four MIDREX Modules have produced over 96 million tons of DRI to date. Hadeed also owns an HYL module (Module D).

JINDAL SHADEED

In 2020, the HOTLINK® plant operated 15% above rated capac-ity and just 1% short of their 2019 record production. The plant operated 8,389 hours in 2020 and set a new monthly production record in March. The module is designed to produce mainly HDRI, with HBI as a secondary product stream. A major portion (~93 %) of its annual production of over 1.7 million tons was consumed as HDRI in Jindal Shadeed’s adjacent steel shop. Jindal Shadeed has produced over 15 million tons since its start-up 10 years ago, despite natural gas availability limitations for most of the 10 years, while averaging 8,222 hours of operation.

Hadeed Module E

Jindal Shadeed

JSPL (Angul)

JSW Steel (Dolvi)

JSPL (ANGUL)

In its 6th year of operation, Jindal Steel and Power Limited’s (JSPL) MxCol Plant in Angul, Odisha State, India, restarted operations in January and remained in operation the rest of the year despite market conditions that were challenging at times. The plant broke their monthly production record twice in 2020, reaching 220 t/h average production rate in the month of December. This is the first MxCol Plant using synthesis gas from coal gasifiers to produce both HDRI and CDRI for the adjacent steel shop. HDRI production was 70% of total production, and coke oven gas (COG) use in the DR plant was ramped up in 2020.

JSW STEEL (DOLVI)

In its 26th year of operation, JSW Steel’s module exceeded annual rated capacity. The system installed at the end of 2014 to reduce natural gas consumption by adding coke oven gas (COG) from JSW Steel’s coke oven batteries to the reduction furnace operated throughout the year, providing 11% of the plant’s energy requirement. The module surpassed the 30-million ton milestone in 2020, and has averaged 8,025 hours of operation per year since its initial start-up in September 1994.

JSW STEEL (TORANAGALLU)

JSW Steel’s HDRI/CDRI module in Toranagallu, Karnataka State, India, using COREX export gas as energy input, produced 75% of its annual production record set in 2018, and surpassed the 5-million-ton milestone in 2020. This is the second plant of its kind – the first one being ArcelorMittal’s COREX/MIDREX Plant at Saldanha, South Africa.

LEBEDINSKY GOK

LGOK’s MIDREX HBI Modules 2 and 3, located in Gubkin, Russia, and belonging to the Metalloinvest Group, set new annual and monthly production records in 2020, with both modules operating around 8,100 hours, and with HBI-3 exceeding the 2 million ton per year mark, the highest annual production from an HBI module and from a 7.0-meter MIDREX Shaft Furnace to date. HBI-3 broke its annual production record for the fourth consecutive year. With close to 27 million tons of combined pro-duction to date, the two modules surpassed the 25-million-ton milestone in 2020. LGOK HBI-1 is an HYL plant.

LGOK HBI-2 and HBI-3

Nu-Iron Unlimited

JSW Steel (Toranagallu)

LISCO

LION DRI

The Lion DRI module, located near Kuala Lumpur, Malaysia, re-mained shut down throughout 2020 due to insufficient market demand for locally produced steel products.

LISCO

Thirty years after the start-up of module 2, production by LISCO’s two DRI modules and one HBI module in Misurata, Libya, continued restricted to less than 50% of rated capacity by factors outside the company’s control.

NU-IRON

After breaking annual and monthly production records in 2019, Nucor’s module in Trinidad and Tobago in 2020 set a new monthly production record during the month of October, reaching an average production rate of 225 t/h. Average DRI metallization for the year was the highest of all MIDREX Plants at over 96.2%, with 2.75% carbon in the DRI.

OEMK

OEMK’s four modules had a combined annual production that was only 2.5% short of their record production of over 3.2 million tons in 2019. The production of all four modules was within 1-8% of their individual record annual production levels. Whereas module 1 underwent major repair work during its annual shut-down in August and went on to set a new monthly production record in October, modules 2, 3 and 4 had shorter shutdowns with modules 3 and 4 operating ~8,450 hours in the year. The total combined DRI output of OEMK surpassed the 75 million-ton milestone in 2020, and module 2, which started up in December 1985, reached its 35-year anniversary.

QATAR STEEL

Both modules started the year at full capacity, but in March Qatar Steel’s dual product (CDRI/HBI) Module 2 was shut down for the remainder of the year and Module 1 began operating at reduced capacity due to poor market demand. Qatar Steel’s Module 1 has produced over 27.5 million tons of DRI since its start-up in 1978, the most for a 5.0-meter shaft furnace.

SIDOR

All four of Sidor’s MIDREX Modules were inactive due to the allocation of the limited supply of oxide pellets in Venezuela to the HBI plants, which produce HBI products for export.

Nu-Iron Unlimited

Tosyali Algérie

voestalpine Texas

SULB

SULB’s 1.5 million t/y combination module (simultaneous CDRI/HDRI production) in Bahrain operated below its annual rated capacity due to soft product demand. Approximately 1.0 million tons of HDRI were sent directly to the steel mill and 74% of the CDRI product was exported, mostly by sea. SULB has produced over 10 million tons since its start-up in 2013.

TENARISSIDERCA

TenarisSiderca operated for only a couple of months towards the beginning of the year and remained shut down for the rest of the year due to limited DRI demand by the steel shop. The module’s DRI metallization percentage was second highest of all MIDREX Plants at 95.40%.

TOSYALI ALGÉRIE

Tosyali Holding’s 2.5 million tons/year combination module, located in Bethioua, near Oran, Algeria, continued ramping up operations. In only its second full year of operation, they produced more than 2.23 million tons of direct reduced iron (DRI) in 2020, which is a world record for a single direct reduction module. They also set a plant monthly production record in March. Despite the market turmoil, the module operated essentially at rated capacity during the second half of the year. This is the largest capacity MIDREX Module built to date, with a 7.5 m diameter Shaft Furnace producing both HDRI and CDRI.

TUWAIRQI STEEL MILLS

The 1.28 million t/y combination module of Tuwairqi Steel Mills, located near Karachi, Pakistan, did not operate in 2020 due to market conditions.

VENPRECAR

VENPRECAR’s HBI production was restricted by the limited availability of iron ore pellets in Venezuela.

voestalpine TEXAS

The voestalpine Texas 2.0 million t/y HBI module located near Corpus Christi, Texas, USA, set a new monthly production record in December 2020. voestalpine Texas is a 100% subsidiary of voestalpine AG in Austria.

EDITOR’S NOTE:

At the time of printing, no detailed information had been received from MIDREX Plants located in Iran.