Iron Ore for Direct Reduction: The Challenge Updated

Introduction

The principal purpose of this article is to provide an update on the iron ore supply to the direct reduction (DR) market, which was last addressed in Direct From Midrex in 2Q2022. To paraphrase the outcome of its analysis of the merchant iron ore pellet supply-demand at the time: Whilst there would be adequacy of pellet supply for DR plants by the middle of the 2020s, the picture would change by the early 2030s, by which time most of the then-assumed new DR projects would be in production. The analysis suggested a significant shortfall in DR/EAF grade pellet supply, as the capacity of existing pellet plants became fully utilised. Looking to the longer term, i.e., by 2050, the challenge was significantly greater, with DR/EAF grade pellet demand exceeding the current level of global pellet production.

The iron ore-to-steel value chain has certainly embraced the iron ore challenge. However, three and a half years down the track, there have been significant changes in the outlook for implementation of new DR projects, notably ArcelorMittal’s various European and Canadian projects being put on hold, which represent about 12 million tonnes per annum (mt/a) annual DRI capacity requiring 17.5-18 mt/a pellets. ArcelorMittal’s press release in November 2024 noted:

- green hydrogen is evolving very slowly towards being a viable reductant source and natural gas-based DRI production in Europe is not yet competitive as an interim solution;

- there are significant weaknesses in the EU carbon border adjustment mechanism (CBAM) and trade protection measures need strengthening in response to increasing imports due to overcapacity in China;

- there is limited willingness among customers to pay premium prices for low-carbon emission steel.

There have been delays to the implementation of other merchant ore-based DR projects in Europe and the MENA region, but further new projects have been announced in the meantime. Tosyali SULB’s 8.1 mt/a project in Libya (phase 1 contracted with Midrex/SMS), aimed at DRI supply to external users is an example of decoupling the iron and steel production processes by shifting iron production from Asia or Europe to the MENA region with its lower cost energy and natural gas (and eventually hydrogen).

Background To DR/EAF Pellet Supply-Demand Scenario Analysis

The updated pellet supply-demand scenario analysis covers the period out to 2034, relative to 2024. It must be emphasised that the analysis represents a scenario, not a forecast – a great deal of water will have flowed under the demand and supply bridges by 2034.

The demand-side reflects DRI production in plants using only merchant iron ore, bringing together existing plants and new projects. Not included is possible longer term requirements from India for DR/EAF grade pellets.

Given the uncertainties surrounding the medium term decarbonisation pathway, this time a limited sensitivity analysis has been included with two supply-side and two demand-side scenarios.

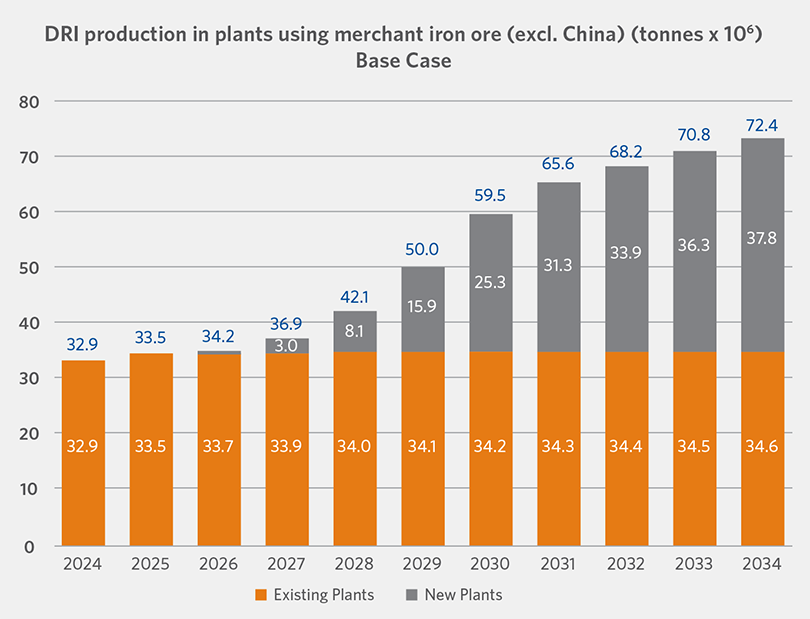

FIGURE 1.

Modelled DRI production – Base Case (historical data from Midrex annual statistics)

Demand-Side Scenario

Figure 1 shows the assumed build-up of DRI production between 2024 and 2034 for the Base DRI Case (countries with existing DR plants using merchant pellets: Argentina, Trinidad, USA, Germany, Algeria, Libya, Egypt, Saudi Arabia, Qatar, UAE, Oman, and Malaysia).

The assumed new merchant iron ore-based DR projects are listed in Table 1. The selection of new projects and their ramp-up is based on company and media reports and in some cases judgmental assumptions only. Specific consumption of iron ore (almost 100% pellets) in all cases is 1.45 tonnes, equivalent to a total of 104.9 mt in 2034 for the base case.

Of course there are many other DR projects at various stages of development, based on both merchant and captive iron ore. In addition, consideration might be given to re-start of several idled DR plants. Midrex’s 2024 World Direct Reduction Statistics lists idle merchant ore-based plants with about 9 mt/a capacity. Candidates for re-start include the former AM Point Lisas plant in Trinidad (three modules), Lion DRI and Perwaja Steel in Malaysia, Al Tuwairqi in Pakistan, and Saldanha Steel (AM South Africa) in South Africa. The “Higher” demand-side sensitivity scenario therefore assumes an additional 4 mt DRI in 2034.

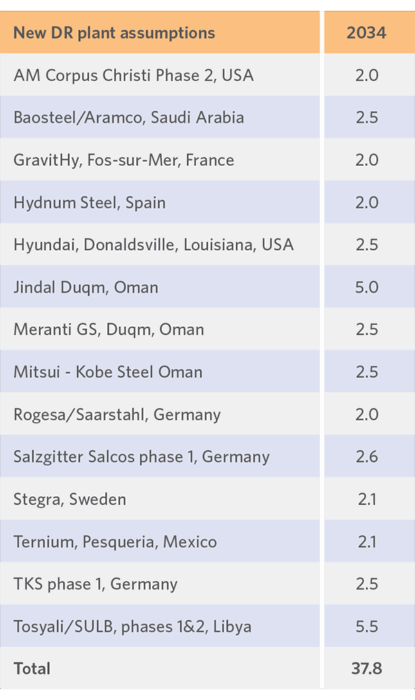

TABLE 1.

Assumed new merchant iron ore-based DR projects - mt

Supply-Side Scenario

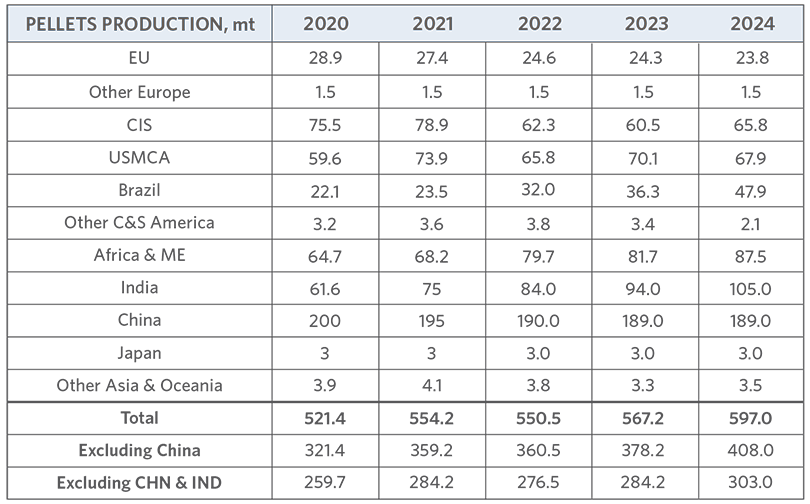

To provide context, Table 2 shows global pellet production during the period 2020-2024. The main increases were in India, Iran, CIS, and Brazil.

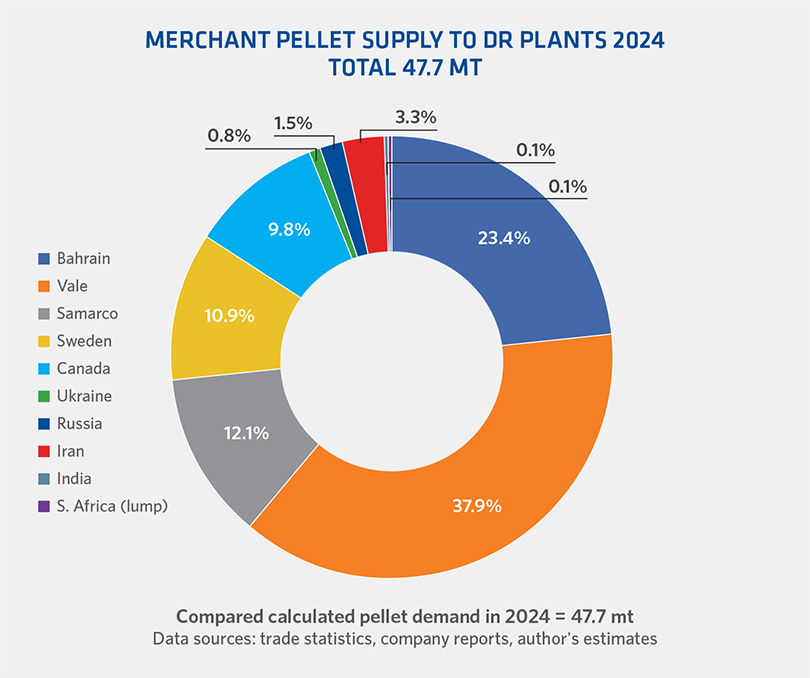

Production outside China and India was 303 mt, about 20 mt above that of 2023. Per International Iron Metallics Association (IIMA) trade statistics, cross-border pellet trade in 2024 was about 114 mt (basis import data). Figure 2 shows merchant pellet supply to DR plants in 2024.

TABLE 2.

Global pellet production by region or country (data sources: company & media reports, national statistics, personal contacts, author's estimates)

FIGURE 2.

Merchant pellet supply to DR plants in 2024

Two pellet supply scenarios have been modelled: a “Higher Case” reflecting the assumed maximum potential merchant supply from the various producers and a more conservative “Lower Case.” The Higher Case assumptions for 2034 are given below and where applicable the corresponding Lower Case assumptions follow in parentheses. Incremental supply is relative to 2024. Supply-side assumptions are based on a variety of inputs, some judgmental in nature.

- Iron Ore Company of Canada: full nameplate capacity of 12 mt/a is achieved with 80% as DR/EAF grade pellets, an incremental 5.4 mt (Lower Case: 11 mt production, 70% as DR/EAF grade, 3.5 mt incremental supply);

- ArcelorMittal Mines Canada: full capacity of 10 mt/a available as DR/EAF grade, an incremental 7.5 mt after supply to in-house DR plants in Canada (Lower Case: 9 mt total production available as DR/EAF grade, an incremental 6.5 mt);

- Vale: 45% of Tubarão capacity of 31.3 mt/a + 100% of Oman capacity of 9 mt/a, an incremental 5 mt (Lower Case: 40% of Tubarão capacity + 100% of 9 mt at Oman, an incremental 3.5 mt);

- Samarco: 65% of full capacity of 26 mt/a, an incremental 11.1 mt (Lower Case: 60% of 26 mt, an incremental 9.8 mt);

Photo courtesy of Samarco, a privately held Brazilian mining company.

- LKAB: full 10 mt/a capacity of the Kiruna KK3 and KK4 pellet plants, an incremental 4.8 mt – LKAB has postponed its transition from pellet to “sponge iron” supplier at Kiruna to the 2040s (Lower Case: 8.5 mt total production, an incremental 3.3 mt);

- Bahrain Steel: full effective capacity of 13 mt/a, all DR/EAF grade, of which ~2.2 mt/a is supplied to the adjacent SULB DR plant, zero incremental supply;

- Jindal Steel Oman: full 6 mt/a capacity of Vulcan Pelletising, all incremental – for the purposes of this exercise Vulcan is treated as a merchant plant as its capacity is not sufficient to supply 100% of Jindal’s eventual DR/EAF pellet requirements in Oman (Lower Case: 5 mt total production, an incremental 5 mt);

- Suez Steel: full 5 mt/a capacity, all incremental, to be consumed in-house/domestically (Lower Case: 4 mt total production, an incremental 4 mt);

- Mesabi Metallics: full 7 mt/a capacity available as DR/EAF grade pellets, an incremental 7 mt (scheduled start-up in 2026) (Lower Case: 6 mt total production, 90% as DR/EAF grade, an incremental 5.4 mt);

- Ukraine: the current war with Russia notwithstanding:

- Metinvest: it is understood that, subject to the addition of flotation circuits at its Northern operation, Metinvest could produce 4–5 mt/a DR/EAF grade pellets by the end of the period, an incremental 4.5 mt (Lower Case: no addition of flotation circuits, zero incremental supply);

- Ferrexpo: 0.5 mt/a DR/EAF grade pellets, zero incremental supply; if Ferrexpo could finance the cost of adding flotation to its beneficiation process it could theoretically produce 4–5 mt DR/EAF grade pellets, but for the purposes hereof this is considered not to happen;

- Blastr Green Steel: 50% of the planned 6 mt/a capacity would be available to the merchant market (Lower Case: 5 mt total production, of which 2.1 mt available to the merchant market);

- BF grade pellets for ESF: 3.5 mt/a for ThyssenKrupp Steel Duisburg (as far as the author is aware, TKS’s project has the only firmly committed ESF, although the concept is being widely studied, for example in South Korea and Australia, e.g. the Neosmjelt project);

- Metalloinvest + other Russian producers: DR/EAF grade pellet production will be consumed by captive/domestic DR plants.

There are several captive pelletising projects at various stages of development (this list is not exhaustive – there are some additional references to pelletising projects in the section on iron ore fines that follows):

- Tosyali Algerie’s #2 pellet plant is now in operation; Tosyali is developing a 6 mt/a iron ore mine in Angola to support its pelletising operations;

- Strategic Resources’ planned 4 mt/a plant at the Port of Saguenay, Canada, based on purchased iron ore concentrate and aimed at the DR market (currently working on funding and concentrate sourcing);

- A pellet plant as part of the low-carbon iron hub planned by the joint venture of Emsteel, Itochu and JFE Steel in the UAE;

- Various projects involving SNIM, Mauritania;

- Maegma Minerals’ HBI plant in Lumut, Malaysia will involve “collaboration with a global high grade iron ore supplier which will operate a pelletising plant near the Maegma site…”

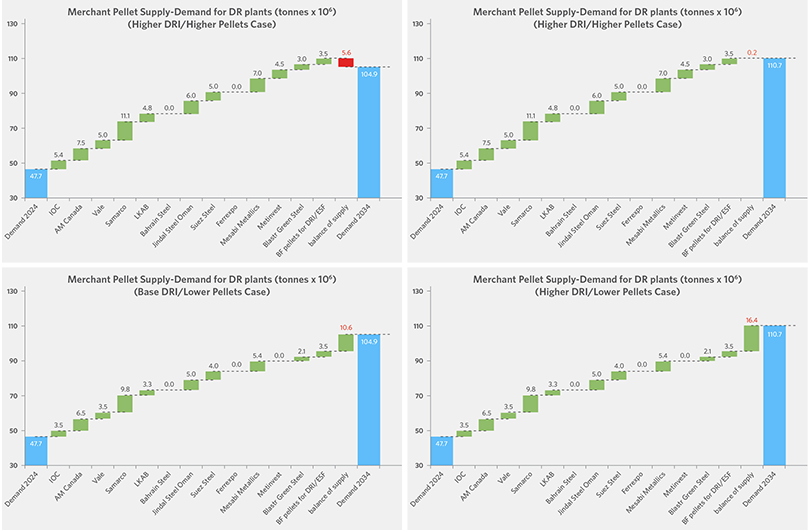

FIGURE 3.

Scenario Analysis Outcomes

Analysis and Summary

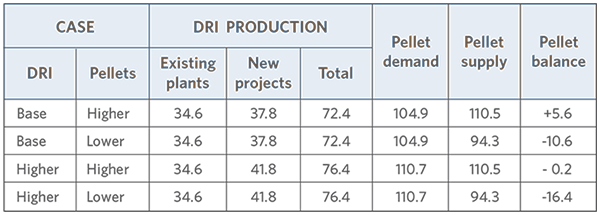

Figure 3 shows the details of the outcomes and Table 3 summarises the results of the scenario analysis. As the supply-

demand balance figures show, for the more conservative lower pellets supply case (lower graphs), there is a pellet supply shortfall for both the base and higher DRI cases, albeit less than suggested by previous analyses. However, for the higher pellets supply case (upper graphs), there is a modest surplus for the base DRI case in 2034, but a more or less balanced supply for the higher DRI case.

TABLE 3.

Scenario Analysis Summary for 2034 (all values MT)

Generally speaking, progress by the iron ore industry in recognition that the transition to carbon-neutral steelmaking will require significantly increased supply of DR/EAF grade iron ore should give a degree of comfort to the DR sector, particularly with respect to medium term supply of DR/EAF grade pellets. However, as the scenario analysis suggests, there is no room for complacency and the DR sector should therefore monitor supply-side developments closely and act accordingly.

Iron Ore Briquettes

Vale is making progress with its cold-bonded briquette project. The (first) BT-01 plant at Tubarão started in December 2023, with capacity of 2 mt/a and is now focussed on the domestic blast furnace market. The planned 4 mt/a BT-02 Tubarão plant has been postponed to post-2027. A smaller mobile plant with capacity of 0.16-0.2 mt/a started in September 2024, with focus on production for large scale industrial trials.

Acid and High-Reducibility Briquettes for use in blast furnaces are now considered as developed products. Briquettes for DR applications are under progressive stages of development:

- laboratory tests

- basket tests (kg scale) – 20 campaigns completed

- flash tests (hundred tonnes scale) are ongoing

- industrial trials (thousand tonnes scale) – four completed, two more planned Vale and Midrex have agreed to cooperate in advancing a technical solution for the use of cold-bonded iron ore briquettes in direct reduction plants.

UK company Binding Solutions is developing a cold-bonded iron ore pellet product, but so far with emphasis on blast furnace use.

Iron ore briquettes

Lump Iron Ore

There is not much new to say on this subject:

- Kumba’s Sishen super high grade lump ore is the principal source of lump ore for DR plants; Kumba has installed Ultra High Density Magnetic Separation (UHDMS) at the Sishen mine as part of a R3.6 billion project to extend Sishen’s mine life to 2038 (with further potential to 2044). UHDMS enables production of >15 mt/a premium 65% Fe lump, as well as increased capability for production of super high grade lump (65.5–66% Fe). Standard Sishen lump ore grades 64% Fe;

- until it is able to expand its production, Baffinland Iron Mines is unlikely to develop a lump product for the DR market in significant volume; in the 2025 shipping season, the company is understood to have delivered about 1.7 mt lump ore grading 67.7% Fe to Europe;

- a possible new supplier is J & F Mineração, which acquired the Santa Cruz and Urucum mines in Brazil’s Mato Grosso do Sul state. The company plans to expand production from 12 mt to 25 mt/a and is developing a “natural pellet” product aimed at the DR market.

High grade lump ore

Iron Ore Fines, Concentrates, Pellet Feed

As is clear, the planned increase in pelletising capacity and the development of fines-based DR technology place emphasis on the need for increased supply of fine iron ore (fines, concentrates, pellet feed). It should be noted that where an ore beneficiation plant is integrated with the pellet plant or an ESF is integrated with a fines-based DR plant, there is a much wider range of supply options. This section will focus on existing and potential future sources of high (DR/EAF) grade ore. Information has been gleaned from company reports/press releases and media reports.

Existing supply of merchant DR/EAF grade fines includes:

- Anglo American’s Minas Rio operation in Brazil (the highest grade material being largely committed to Bahrain Steel under a 20-year contract); an agreement between Anglo American and Vale was announced in February 2024, whereby Vale will acquire 15% of Anglo American Minério de Ferro Brasil (owner of Minas Rio) and the two parties will establish a partnership effectively combining Minas Rio with Vale’s contiguous (and higher grade) Serro da Serpentina reserves; Vale will allocate its share of the production to its own pellet and eventually briquetting plants (initially 3.8 mt/a, but potentially up to 15 mt/a in the longer term); this partnership will enable significant expansion beyond Minas Rio’s current 26.5 mt/a capacity, as well as various logistics options (2024 production at Minas Rio was 25 mt and guidance for 2025 has been increased by 1 mt to 23–25 mt).

- Occasional supply from Samarco if/when there is an imbalance between pellet feed production and internal demand.

- Champion Iron’s Bloom Lake operation in Canada, producing 66.2% Fe concentrate (FY 2024 production 14.2 mt).

- Kaunis Iron in Sweden, currently producing about 2 mt/a of high-grade concentrate with plans to expand capacity. It is currently reviewing its longer-term strategy. A press release in 2024 refers to collaboration with Stegra to establish a pellet plant in Narvik in 2030.

- Compañía Minera del Pacífico in Chile produces several high-grade magnetite concentrates, grading up to 69% Fe. 2024 shipments totalled 15.3 mt, including about 12 mt pellet feed. Indefinite closure of CAP’s steelmaking operations having been announced in 2024, the group plans major investments to increase high-grade iron ore production from 17 mt in 2023 (average 66% Fe) by 38% to 23 mt/a (average 68% Fe) by 2032.

Photo courtesy of Samarco.

Are There Enough Dr/Eaf Grade Iron Ores Available For The Longer Term?

New projects include the following (this list – in no particular order of priority – is by no means exhaustive):

- Champion Iron’s DRPF project to upgrade the 7.5 mt/a Bloom Lake Phase 2 plant in Quebec from 66.2% to 69% Fe is progressing on schedule – commissioning is scheduled to start in December 2025 with commercial shipments by the end of H1 2026. Worthy of mention is Champion’s past acquisition of the old Wabush pellet plant at Pointe Noire which, if re-commissioned/refurbished, could add about 5 mt/a to DR/EAF grade pellet supply.

- Champion Iron has entered into a definitive framework agreement with Nippon Steel and Sojitz Corp. for joint ownership and development of the Kami project (close to the Bloom Lake mine). The Definitive Feasibility Study (DFS) is scheduled for completion by end 2026. The project construction period is estimated at 48-months following FID (final investment decision). Life-of-mine is foreseen at 25 years, with average production of approximately 9.0 mt/a iron ore concentrate grading >67.5% Fe.

- Cyclone Metals’ (Australian) Iron Bear project in the Labrador trough in Quebec, Canada, has recently announced the launch of a pre-feasibility study, due for completion in Q2 2026. A scoping study, released in August 2025, indicates a potential 25 mt/a magnetite concentrate operation, of which 16 mt/a is BF grade concentrate grading close to 70% Fe and 9 mt/a further processed to DR/EAF grade pellets grading 71% Fe/1.1% SiO2. Ramp up is foreseen at 12.5 mt in year 2, 17.5 mt in year 5 (when pellet production would commence) and 25 mt in year 6. Cyclone has executed a Development Agreement with Vale regarding joint development of the project. FID is foreseen in 2028.

- Other projects in Quebec with DR/EAF grade concentrate potential include Barlow Metals’ Iron Hills, Oceanic Iron Ore’s Hopes Advance, Metal Quest Mining’s Lac Otelnuk, Cerrado Gold’s Mont Sorcier, Red Paramount Iron’s Lac Virot and High Tide Resources’ Labrador West projects (the last-named may include pelletising).

- Magnum Mining & Exploration’s Buena Vista magnetite project in Nevada, USA aims to produce DR/EAF grade magnetite concentrate (grading 69.5% Fe). All major development permits have been secured.

- CSN Mineração’s plans to increase capacity at the Casa de Pedra mine in Brazil from about 30 mt up to 68 mt/a by 2028 with an average Fe content of about 65%. This will include 21.5 mt/a of 67% Fe material, 16.5 mt/a of which as pellet feed from processing itabirite ore and 5 mt/a from processing tailings.

- ArcelorMittal is close to completing expansion of capacity for DR/EAF grade pellet feed at its Serra Azul mine in Brazil, from 1.6 mt/a currently to 4.5 mt/a by end 2025.

- Bahia Mineração (Bamin), owned by ERG (Eurasian Natural Resouces Group) plans to increase capacity of its Pedra de Ferro mine in Brazil to 26 mt/a to produce 10 mt/a direct shipping ore (DSO) and 15-16 mt/a high grade concentrate + pellet feed with average 67-68% Fe (the latter aimed primarily at producers of DR/EAF grade pellets). Current annual production is reported at about 2 mt/a of 65-66% Fe product. Project capex is €5.7 billion (for the mine expansion, railway and deep-sea port). The first shipment from the expanded operation will probably be postponed from the planned 2027 to Q4 2031 given the investment involved. ERG is seeking new investors and is examining non-binding offers from three different bidders.

- Cadence Minerals has signed a conditional Heads of Terms with a prospective offtaker for its Amapa magnetite ore project in northern Brazil, involving funding of the refurbishment of its Azteca plant, initially to process the large stock of tailings. The eventual plan is to develop a 5.5 mt/a 67.5% Fe DR/EAF grade concentrate operation.

- Centaurus Metals announced in late 2024 that its 100% owned Jambreiro Iron Ore Project in Brazil was awarded priority status by the State of Minas Gerais. The company aims to produce a DR/EAF grade pellet feed grading >67.5% Fe. Studies are ongoing.

- Canadian company Black Iron’s Shymanivske project in Ukraine (first phase 4 mt/a, second phase 8 mt/a 68% Fe pellet feed) – most recently, the company signed a multi-year agreement with the city of Krivyi Rih to lease 248 hectares of land which will enable it to complete the research required to renew its special permit for the project’s development. The company has also entered into a royalty and offtake agreement with Anglo American.

- Nordic Iron plans to produce 1.6 mt/a 68-69% Fe magnetite concentrate at the Blötberget mine in Sweden. Following a strategic review earlier in 2025, a revised DFS is targeted by end 2025.

- In May 2024 GRANGEX AB announced completion of the acquisition of the Sydvaranger mine at Kirkenes on the Russian border in the far north of Norway. Mining ceased in 2015 when then-owner Northern Iron went bankrupt. Also in May 2024 GRANGEX executed a conditional life-of-mine offtake agreement with Anglo American. In September 2025 GRANGEX announced the completion of a DFS for the restart of operations, to produce 63.3 mt 70% Fe magnetite concentrate over a 25 year mine life, with commercial exports starting in late 2026. FID is expected by end 2025.

- GRANGEX AB also intends to restart the Dannemora mine in Sweden to produce 1.1 mt/a 68% Fe magnetite concentrate over an 11 year mine life – the company’s website includes the DFS report from June 2024, but the current project status is unknown.

- Beowulf Mining’s Kallak North project in Sweden is targeting 2029 start-up, to produce about 2.7 mt/a magnetite concentrate at >70% Fe with an initial 14 year mine life; future steps before FID can be taken are PFS, DFS and granting of the environmental permit.

- Metinvest, Ukraine is something of a wild card given the current war situation. In 2024, it produced almost 15 mt merchant iron ore, of which 59% was concentrates, 41% pellets. It is understood that, assuming installation of flotation at the Northern operation and the production of 4.5 mt/a pellets, merchant supply of DR/EAF grade concentrates could be about 7 mt/a.

- The Gara Djebilet deposit in Tindouf Province, Western Algeria was discovered in 1952 with estimated exploitable reserves of ~1.7 billion tonnes at >50% Fe. A mine was partially commissioned in mid-2022. The main technical challenge of this ore is to reduce the phosphorus content from 0.8% down to 0.1% – Metallurgical Corp. of China (MCC) is assisting state-owned company SONAREM (Société Nationale de Recherches et d’Exploitation Minières) in developing a roadmap to deal with this issue. China Railway Construction Co. (CRCC) is constructing a 620 km railway to link Gara Djebilet with a deep water port on the Algerian coast, due for completion in 2026. Governmental plans are for initial annual production of 10-12 mt/a by 2032, building up to 40 mt/a by 2040. According to media reports, the first processing plant (crushing, screening, dry separation) will produce up to 4 mt/a, starting April 2026, and be operated by SONAREM.

- The Simandou mine in Guinea requires no introduction here. Rio Tinto recently announced that Simfer (the consortium of which it is the leading member) is due to start shipments in November 2025, with 0.5-1 mt by the year-end and 60 mt/a within 30 months. Combined production of the two consortia will reach 120 mt/a. Rio Tinto has reported Mineral Resources exclusive of ore reserves of 1.4 billion tonnes at 66.1% Fe and low impurities. The mine will initially deliver a single fines product with the potential to transition to a dual-fines product offering of BF and DR/EAF grades. Phosphorus content could be an issue with the latter. The government is pushing for domestic processing of iron ore – a recent media report notes that current agreements with the government require the two consortia to study and build a 0.5 mt/a steel plant or a 2 mt/a pelletising plant.

- Mauritanian state-owned iron ore miner SNIM exported about 14 mt various iron ore products (but no pellets) in 2024 and reportedly plans to increase production to 45 mt/a by 2031 (of which 20 mt/a from SNIM’s existing operations, the balance from JV projects, including El Aouj with Glencore and Takamul with Hadeed) and further to 80 mt/a by 2045. Mauritania is much mentioned as a potential source of “green” DR/EAF grade concentrates/pellets given its abundant solar and wind capacity and thus ideally suited to become a producer of renewable clean energy and green hydrogen at competitive cost. A recent quote from SNIM’s CEO suggests that eventual DR/EAF pellet capacity will be between 2.5 and 4 mt/a, dependent on energy availability. SNIM also has several collaborative sustainability initiatives involving DRI/HBI production.

- The Zanaga iron ore project in Congo-Brazzaville is a potential source of DR/EAF grade pellet feed. A 30 year mine life is foreseen, with production of 12 mt/a at 66% Fe during stage 1 and 18 mt/a at 67.5% Fe, expanding to 30 mt during stage 2. The project team is evaluating potential key value-adding operations, such as pelletising. These important preparatory steps will place the project in a position to seek financing and progress to development when market conditions are favourable. Value adding activities also include the establishment of port and power agreements, as well as issue of the environmental permit.

- Stage 1 of Akora Resources’ Bekisopa iron ore project in Madagascar envisages production of 2 mt/a DSO; Stage 2 envisages upgrading the ore by grinding and magnetic separation to a >67% Fe 75µm concentrate for the DR market.

- Ivanhoe Atlantic hopes to start construction at its 85% owned Kon Kweni (aka Nimba) project in Guinea in Q1 2026, ore to be shipped via Liberia to a new deep-water port at Didia. The project has a total resource of 751.9 mt DSO, of which 209 mt is high grade ore grading 67.8%.

- Finally Australia, which as the world’s largest iron ore exporter could justify an article by itself, given the number of “green iron” projects and associated iron ore developments. There are various initiatives aimed at utilising the Pilbara hematite-goethite ores in the decarbonisation process – these ores are difficult and costly to beneficiate as some impurities, such as phosphorus, are bound up in the crystal lattice. One initiative is the Neosmelt project which brings together the expertise of BHP, BlueScope Steel, Mitsui Iron Ore Development, Rio Tinto Iron Ore and Woodside Energy. The Project involves the development of a pilot facility to investigate the feasibility of the DRI-ESF route to address the use of Pilbara ores in lower-carbon emission steelmaking with FID planned for mid-2026.

- The other route for Australia involves the use of magnetite ore, from both existing and undeveloped deposits. The former include FMG’s Iron Bridge operation in the Pilbara and Karara Mining’s operation in the Midwest region of Western Australia (WA). There are many magnetite projects across Australia including (in no particular order) Hancock Prospecting’s Mt. Bevan, Asia Iron’s Extension Hill, Athena Resources’ Byro Magnetite and MacArthur Minerals’ Lake Giles projects, all in WA, Magnetite Mines’ Razorback, Iron Road’s Central Eyre Iron (CEIP), Lincoln Minerals’ Green Iron Magnetite and Grange Resources’ Southdown projects, all in South Australia, Hawsons Iron’s Magnetite project in New South Wales and Central Queensland Metals’ Eulogie project (a vanadiferous titanomagnetite deposit).

Key Takeaways

- The slowdown in the implementation and ramp-up of some DR projects, coupled with the progress by the iron ore industry in recognizing that the transition to carbon-neutral steelmaking will require significantly increased supply of DR/EAF grade iron ore should have given a degree of comfort to the DR sector where iron ore feedstock is concerned, particularly with medium term supply of DR/EAF grade pellets. However, as the scenario analysis suggests, there is no room for complacency, and the DR sector should therefore monitor supply-side developments closely and act accordingly.

- The prospect of a future shortage of DR/EAF grade pellets has led quite a few DR project developers to consider captive pellet supply, often without a captive or contracted iron ore supply. The many new iron ore projects with scope to supply DR/EAF grade ore should therefore give encouragement to those planning captive pellet supply. Of course, not all these iron ore projects will be successful and prospective pellet producers should monitor developments accordingly.

The author wishes to thank friends and colleagues who have helped in preparing this article.