Story

Energy is the New Driver for Siting DR Plants

September 15, 2025

Direct Reduced Iron (DRI) has long enabled steelmakers to establish operations in regions lacking traditional raw materials or infrastructure for integrated steelmaking. With no need for coke ovens or blast furnaces, the DRI process made it possible to produce high-quality iron units from local or imported ore and locally available natural gas, enabling countries from the Middle East to Latin America to build up competitive domestic steel industries on new terms.

While access to low-cost gas was once the critical enabler, the equation is now changing. In a decarbonizing world, the ability to secure clean, stable, and affordable energy is becoming the primary factor in deciding where DR plants, and in some cases new steelmaking capacity, can be located.

This shift is being driven by the rise of hydrogen-based DRI, which requires vast amounts of clean electricity to produce green hydrogen. But even beyond hydrogen, the broader DR process depends increasingly on low-carbon power systems for plant operations, auxiliary loads, and grid integration. In this context, clean energy refers not only to green hydrogen, but also to the renewable or low-emission sources that make it possible: hydropower, solar, wind, and, in some countries, nuclear. These energy sources, when combined with sufficient infrastructure and supportive policy, now form the critical foundation for siting new DR plants.

From Gas Advantage to Energy Systems

For decades, the key to siting a DR plant was straightforward: follow the natural gas supply.

Countries like Venezuela, Russia and Iran offered abundant, low-cost gas as well as access to iron ore. Others, such as Saudi Arabia, Qatar and Oman, which are also blessed with a plentiful supply of natural gas and the political will to invest in the downstream industry, did not always have domestic supplies of high-grade iron ore, but DR-grade pellets or concentrates could be imported from major exporters such as Australia, Brazil, Canada, and Sweden.

This model of low-cost local gas plus imported ore allowed steelmaking to expand to regions that would have been impractical for conventional blast furnace operations due to a lack of coal. In doing so, it helped reshape the steel industry’s geography.

Today, a similar shift is underway, but the constraint is no longer natural gas: it’s low-carbon energy, especially in the form of green hydrogen and therefore green power. Natural gas can be imported in the form of Liquefied Natural Gas (LNG), although this is expensive and requires extensive infrastructure such as regasification terminals. At the same time, hydrogen is not currently transported and is likely to be costly until production is vastly scaled up from today’s levels.

A New Map for H₂-based DRI

Recent research has underlined how access to renewable energy is becoming both a key constraint and a significant opportunity in the rollout of hydrogen-based DRI.

In Wang et al. (2025), the authors assessed the feasibility of hydrogen-based DRI in China. They concluded that over 50% of the country’s existing steelmaking capacity is not co-located with sufficient renewable energy to produce green hydrogen at scale. This suggests that traditional steel clusters may not be the best candidates for hydrogen-based DRI, unless significant new energy infrastructure is developed.¹

Devlin et al. (2023) identified over 300 potential locations globally that could be suitable for green hydrogen steel production.

Their findings show that the strongest potential lies in renewable-rich regions like Patagonia, Western Australia, and North Africa — areas not traditionally associated with steelmaking.²

This marks a turning point: DR plant locations are now dictated less by where steel is made today, and more by where the right energy systems exist, or can be built; the iron produced can be shipped to steelmakers (in the form of HBI) or used in newly built steelmaking operations.

Technology to Fit the Transition

Midrex technology has always been designed for flexibility, making it a strong fit for the new energy-driven logic of plant location.

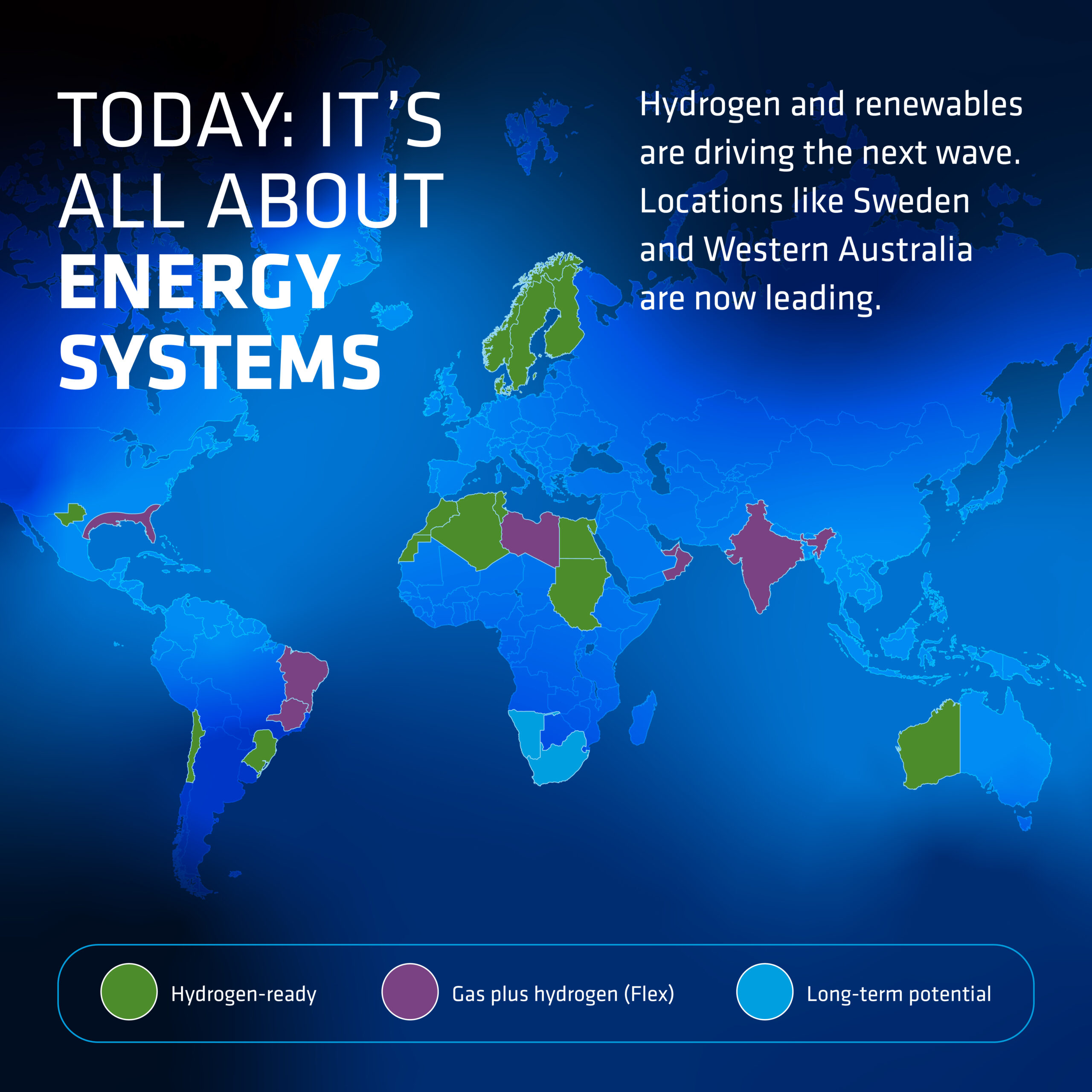

Where renewable power is abundant and stable, such as in parts of Scandinavia, South America, or Australia, the MIDREX H2™ configuration offers a fully hydrogen-based solution with near-zero direct CO₂ emissions. Locations with access to steady, low-cost green electricity can make the onsite production of hydrogen economical, allowing steelmakers to leapfrog to fully decarbonized DRI.

In transitional markets where natural gas is still accessible but hydrogen infrastructure is emerging, MIDREX Flex® offers a hybrid pathway to decarbonizing the production process. In this configuration, operation begins with a high share of natural gas and then gradually substitutes hydrogen over time. This means a company can reduce emissions without having to wait for full hydrogen readiness. Countries like Brazil, Oman, and India may benefit from this flexible approach.

In regions where natural gas remains abundant and cost-effective, and where the policy or infrastructure environment does not yet support hydrogen, a MIDREX Flex plant can operate with 100% natural gas and includes provisions for future H2 use, continuing to deliver the strong performance and value expected from the over 100 plants constructed. Examples include the US Gulf Coast and parts of North Africa, where energy costs and export infrastructure still favour natural gas-based production.

This flexible approach ensures that Midrex DR technology remains deployable across a variety of geographies, from first movers to fast followers, supporting steelmakers at every stage of the energy transition.

What Makes a Region Viable Today?

To site a future-ready DR plant, several critical elements must align. Chief among them is access to low-carbon, stable energy, whether from wind, solar, hydro, or nuclear sources (or a combination thereof). Equally important is grid reliability and the availability of water, which are both essential for large-scale green hydrogen production.

While access to DR-grade iron ore is vital, it does not limit location, thanks to global shipping routes and the widespread trade of imported pellets or concentrates. More decisive are the logistical capabilities, such as port infrastructure, local transport, and storage, that enable efficient handling of feedstocks and products. Supportive industrial policy, long-term price visibility, and the ability to export HBI also play a defining role.

Certain regions are already emerging as leaders. Sweden and Norway, for example, offer abundant hydropower, strong climate policy alignment, and a highly stable grid, making them strong candidates for future hydrogen-based DR steelmaking. France’s power is primarily from nuclear power, providing stable and decarbonized electricity. Chile and Australia are home to some of the world’s best solar and wind resources. Oman and the UAE bring a proven track record in DR, existing infrastructure, and ambitious hydrogen strategies. Australia, uniquely, sits atop premium iron ore reserves and is ramping up renewable generation, making it a compelling candidate for fully integrated green steel production.

Merchant HBI: Distributed Steelmaking Advantage

Merchant HBI has long played a role in global steel supply. Countries such as Venezuela and Russia have historically exported HBI produced using low-cost natural gas and iron ore. What is changing now is the opportunity to produce merchant HBI with a significantly lower carbon footprint by siting DR plants in regions with abundant low-carbon or renewable energy.

This approach does not depend on the presence of a local meltshop. Instead, it reflects a shift in siting logic driven by access to clean energy. By exporting clean iron units from energy-rich regions to industrial centres where renewable electricity or green hydrogen is scarce, merchant HBI can support a more distributed and cooperative model of steel decarbonization. This allows countries to align their natural advantages with growing global demand for low-emission steel inputs.

Conclusion

DRI has always unlocked opportunities for steelmaking in places where traditional methods would not work. Historically, it empowered countries without coking coal or blast furnaces to build competitive steel industries using local gas and imported ore.

Today, as energy systems evolve, the logic of DRI siting is changing. The decisive factor is no longer access to gas: it is access to clean, reliable energy. From hydrogen-rich Scandinavia to renewable- and resource-rich Western Australia, the map is shifting.

In this new world, energy is the anchor, and Midrex is ready to help build the future wherever the opportunity lies.

References

¹ Wang, L., Lin, X., Liu, Z., et al. (2025). Uneven renewable energy supply constrains the decarbonization effects of excessively deployed hydrogen-based DRI technology. Nature Communications, 16, Article 4251.

² Devlin, B., Czernie, A., Crolius, S., & Meijer, K. (2023). Mapping global opportunities for hydrogen-based steelmaking. Smart Steel Technologies, supported by the World Economic Forum and Mission Possible Partnership.